Double Taxation Avoidance Agreement – Article 7 Business Profits

Article 7 of the UN Model Convention and the OECD Model Convention deals with the taxation of business profits in a cross-border context.

Double Taxation Avoidance Agreement – Article 7 Business Profits

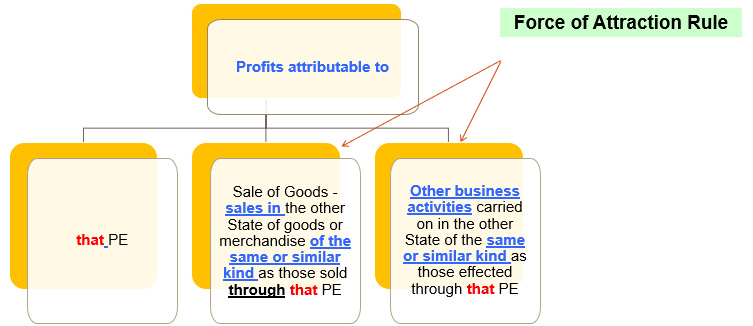

Article 7(1) of the OECD Model Convention is similar to the UN Model Convention with the exception that the OECD Model Convention, does not incorporate the “Force of Attraction” rule. The Force of Attraction Rule allows the Source State to tax a foreign enterprise for income in the Source Country if the enterprise has a PE, even if such income is not economically connected with the PE.

To illustrate Force of Attraction Rule: if a foreign company sells certain goods through a showroom in the Source State, even direct sales to the customer from an overseas entity would be attributed to the PE and would be treated as profits arising from the PE.

- Article 7(1) does not apply to business profits dealt with by Article 8 (Shipping profits), 10 (Dividends), 11 (Interest) or 12 (royalties). Such profits can be taxed under the respective Article in the Source State, even in the absence of a PE in the Source State.

- Further, income derived from furnishing of independent personnel services falls under Article 7 of the OECD Model Convention due to the deletion of Article 14 in the OECD Model Convention (which is present in the UN Model Convention).

Article 7(1) of the UN Model Convention provides the right to the State of Source to tax profits of an enterprise of State of Residence if, both the following conditions are fulfilled:

– Enterprise carries on business in the Source State; and

– Such business is carried on through a PE in that State.

Under the “Force of Attraction” Rule, the Source State may tax a foreign enterprise for income in the Source Country, if the enterprise maintains a PE, even if such income does not have an economic connection with the PE. This is on basis that if a foreign enterprise has a PE, it brings itself within the fiscal jurisdiction of the Source State to such a degree that all profits that the enterprise derives from the State of Source, whether through the PE or not, can be taxed by it (State of Source).

Even in such a case, only so much profit as is attributable to the following can be taxed:

– The PE;

– Sales of the same or similar goods or merchandise as those sold through that PE in the Source State – “Force of Attraction”; or

– Other business activities carried on in the Source State of the same or similar kind as those effected through that PE.

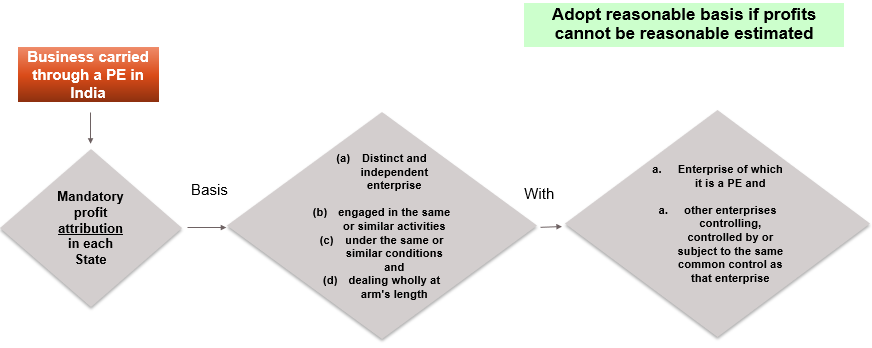

This Article provides for the computation of profits of the permanent establishment. It provides that for computing profits, the PE should be treated as an independent and separate entity. Accordingly, the transaction of the PE with the head office of its other related enterprise, are to be re-casted, assuming these are two independent entities. Some of the assumptions in the computation of profits are that a PE is: –

- A separate and independent enterprise,

- It is engaged in the same or similar activities

- Such activities are performed under the same or similar conditions,

- The profits, to be attributed to the PE have to be calculated considering what are the functions of the PE, what are the assets used by the PE in rendering these functions, and what are the risks assumed by the enterprise

- It is assumed that the PE is dealing wholly independently with the enterprise of which it is a permanent establishment.

Article 7(3) of the UN Model Convention relating to the deduction of expenses, is absent in OECD Model Convention.

Comments

Article 7(3) of the OECD Model Convention deals with the case, in which the provisions of Article 7(2) are applied and result in a tax adjustment in the State of Source. Given that such an adjustment is likely to result in an increase in tax in the Source State, Article 7(3) provides that the state of residence should provide a corresponding adjustment in the taxation of NR to avoid double taxation.

Additionally, the Competent Authorities of the Contracting States can consult each other, if necessary, for the determination of the adjustments.

This clause is absent in UN Model.

Article 7(4) of the UN Model Convention, is a machinery provision, that relates to the determination of the profits to be attributed to a PE based on an apportionment of the total profits of the enterprise to its various parts, each of which may be contributing to its profitability. This clause is absent in the OECD Model Convention. Article 7(4) prescribes that the method to be used should be the one where the result is in accordance to the principles as per the Article.

It is applied only where it has been customarily used in the past and accepted both by the tax authorities and taxpayers as being satisfactory which shall not be restricted through Article 7(2).

Article 7(5) of the UN Model Convention relates to the use of the same method for attribution of profits to a PE, year by year unless there is goodand sufficient reason to the contrary, i.e., to not use the same method.

This provision is absent in OECD Model Convention.

It is a well-settled principle that a specific provision overrides a general one. In line with this principle, ARTICLE 7(4) of the OECD Model Convention provides that if an enterprise has profits, which relate to items of income dealt with in other Articles (say interest, dividend, royalty, fee for technical services etc), those Articles shall not be affected by the provisions of this Article. It may however be noted that in case those articles provide for taxation of income effectively connected with a PE under Business Profits, then the provision of this Article would be applicable. The similar provision exists in Article 7(6) of the UN Model Convention.

| 7 | BUSINESS PROFITS | BUSINESS PROFITS | BUSINESS PROFITS | |||

| 1 | The profits of an enterprise of a Contracting State shall be taxable only in that State unless the enterprise carries on business in the other Contracting State through a permanent establishment situated therein. If the enterprise carries on business as aforesaid, the profits that are attributable to the permanent establishment in accordance with the provision of paragraph 2 may be taxed in that other state. | The profits of an enterprise of a Contracting State shall be taxable only in that State unless the enterprise carries on business in the other Contracting State through a permanent establishment situated therein. If the enterprise carries on business as aforesaid, the profits of the enterprise may be taxed in the other State but only so much of them as is attributable to (a) that permanent establishment; (b) sales in that other State of goods or merchandise of the same or similar kind as those sold through that permanent establishment; or (c) other business activities carried on in that other State of the same or similar kind as those effected through that permanent establishment. | Profits of an enterprise of a Contracting State shall be taxable only in that Contracting State unless the enterprise carries on business in the other Contracting State through a permanent establishment situated therein. If the enterprise carries on business as aforesaid, the profits that are attributable to the permanent establishment in accordance with the provisions of paragraph 2 of this Article may be taxed in that other Contracting State. | |||

| 2 | For the purposes of this Article and Article [23 A] [23 B], the profits that are attributable in each Contracting State to the permanent establishment referred to in paragraph 1 are the profits it might be expected to make, in particular in its dealings with other parts of the enterprise, if it were a separate and independent enterprise engaged in the same or similar activities under the same or similar conditions, taking into account the functions performed, assets used and risks assumed by the enterprise through the permanent establishment and through the other parts of the enterprise. | Subject to the provisions of paragraph 3, where an enterprise of a Contracting State carries on business in the other Contracting State through a permanent establishment situated therein, there shall in each Contracting State be attributed to that permanent establishment the profits which it might be expected to make if it were a distinct and separate enterprise engaged in the same or similar activities under the same or similar conditions and dealing wholly independently with the enterprise of which it is a permanent establishment. | ||||

This Article provides for the computation of profits of the permanent establishment. It provides that for computing profits, the PE should be treated as an independent and separate entity. Accordingly , the transaction of the PE with the head office are other related enterprise, are to be recasted, assuming these are two independent entities. Some of the assumptions in computation of profits are that a PE is : –

Article 7(3) of the UN Model relating to deduction of expenses, is absent in OECD Model. |

||||||

| 3. | In the determination of the profits of a permanent establishment, there shall be allowed as deductions expenses which are incurred for the purposes of the business of the permanent establishment including executive and general administrative expenses so incurred, whether in the State in which the permanent establishment is situated or elsewhere. However, no such deduction shall be allowed in respect of amounts, if any, paid (otherwise than towards reimbursement of actual expenses) by the permanent establishment to the head office of the enterprise or any of its other offices, by way of royalties, fees or other similar payments in return for the use of patents or other rights, or by way of commission, for specific services performed or for management, or, except in the case of a banking enterprise, by way of interest on moneys lent to the permanent establishment. Likewise, no account shall be taken, in the determination of the profits of a permanent establishment, for amounts charged (otherwise than towards reimbursement of actual expenses), by the permanent establishment to the head office of the enterprise or any of its other offices, by way of royalties, fees or other similar payments in return for the use of patents or other rights, or by way of commission for specific services performed or for management, or, except in the case of a banking enterprise, by way of interest on moneys lent to the head office of the enterprise or any of its other offices. | |||||

| 3 | Where, in accordance with paragraph 2, a Contracting State adjusts the profits that are attributable to a permanent establishment of an enterprise of one of the Contracting States and taxes accordingly profits of the enterprise that have been charged to tax in the other State, the other State shall, to the extent necessary to eliminate double taxation on these profits, make an appropriate adjustment to the amount of the tax charged on those profits. In determining such adjustment, the competent authorities of the Contracting States shall if necessary consult each other. | |||||

| Comments

Article 7(3) deals with the case, in which the provisions of Article 7(2) are applied and results in a tax adjustment in the State of Source. Given that such an adjustment is likely to result in an increase in tax in the Source State, Article 7(3) provides that the state of residence should provide a corresponding adjustment in the taxation of NR to avoid double taxation. This clause is absent in UN Model. |

||||||

| 4. In so far as it has been customary in a Contracting State to determine the profits to be attributed to a permanent establishment on the basis of an apportionment of the total profits of the enterprise to its various parts, nothing in paragraph 2 shall preclude that Contracting State from determining the profits to be taxed by such an apportionment as may be customary; the method of apportionment adopted shall, however, be such that the result shall be in accordance with the principles contained in this article. | ||||||

| Article 7(4) of the UN Model , is a machinery provision, relates to determination of the profits to be attributed to a PE on the basis of an apportionment of the total profits of the enterprise to its various parts, each of whom may be contributing to its profitability. This clause is absent in the OECD Model. Article 7(4) prescribes a method different from that in Article 7(2), and may result in different attribution of profits, which are from that obtained by applying of Article 7(2). It is applied only where it has been customarily used in the past and accepted both by the tax authorities and taxpayers as being satisfactory. | ||||||

|

|

5. For the purposes of the preceding paragraphs, the profits to be attributed to the permanent establishment shall be determined by the same method year by year unless there is good and sufficient reason to the contrary. | |||||

| Article 7(5) of the UN Model relating to use of same method for attribution of profits to a PE , year by year unless there is good

and sufficient reason to the contrary, is absent in OECD Model. |

||||||

| 4 | Where profits include items of income which are dealt with separately in other Articles of this Convention, then the provisions of those Articles shall not be affected by the provisions of this Article. | 6. Where profits include items of income which are dealt with separately in other articles of this Convention, then the provisions of those articles shall not be affected by the provisions of this article. | ||||

| It is a well-settled principle that a specific provision overrides a general one. In line with this principle, ARTICLE 7(4) of the OECD Model provides that if an enterprise has profits, which relate to items of income dealt with in other Articles (say interest, dividend, royalty , fee for technical services etc) , those Articles shall not be affected by the provisions of this Article. It may however be noted that in case those article provide for taxation of income effectively connected with a PE under Business Profits, then the provision of this Article would be applicable. | ||||||

RELEVANCE OF ARTICLE 7 BUSINESS PROFITS

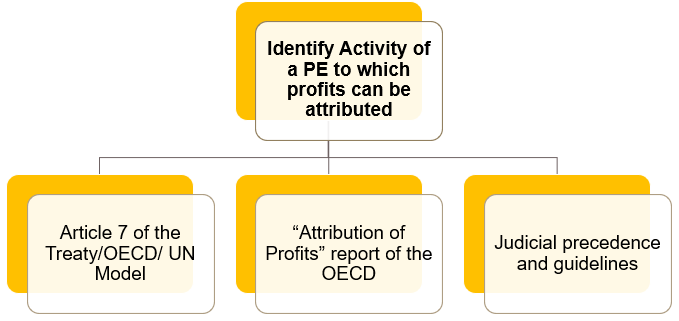

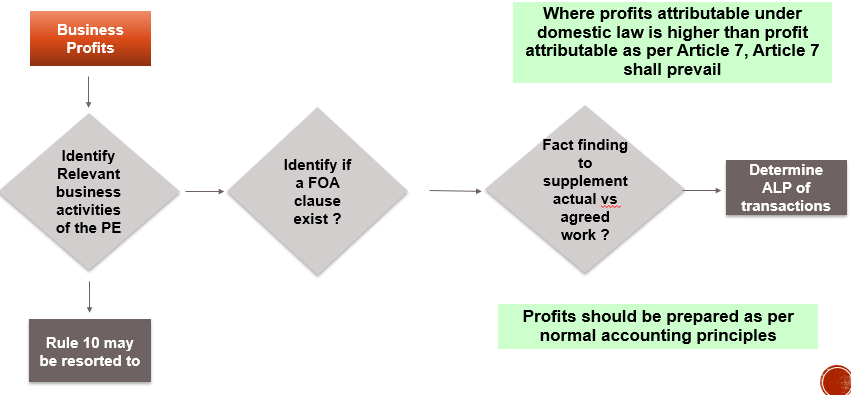

METHODOLOGY OF ATTRIBUTION OF PROFITS

ARTICLE 7 – INDIA USA TREATY

7(1) – Rights of the Contracting States to tax business profits of an Enterprise

7(2) – PE to be considered a a distinct and separate enterprise for computing profits

7(3) – Corresponding Adjustment by State of residence

7(4) – Specific Article that deal with income in other clauses to override PE clause – Exceptions

7(5) – Purchase of Goods

7(6) – Consistent method Year on Year

7(7) – Consistent method Year on Year

ARTICLE 7(1) – INDIA USA TREATY

The profits of an enterprise of a Contracting State shall be taxable only in that State

unless the enterprise carries on business in the other Contracting State

through a permanent establishment situated therein.

If the enterprise carries on business as aforesaid,

the profits of the enterprise may be taxed in the other State

but only so much of them as is attributable to

(a) that permanent establishment ;

(a) sales in the other State of goods or merchandise of the same or similar kind as those sold through that permanent establishment ; or

(b) other business activities carried on in the other State of the same or similar kind as those effected through that permanent establishment.

CHARACTERSTICS OF ARTICLE 7(1)

WHAT IS TAXABLE UNDER ARTICLE 7 BUSINESS PROFITS

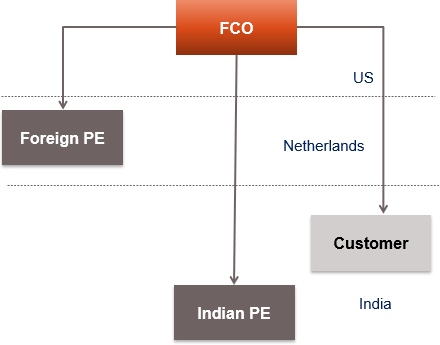

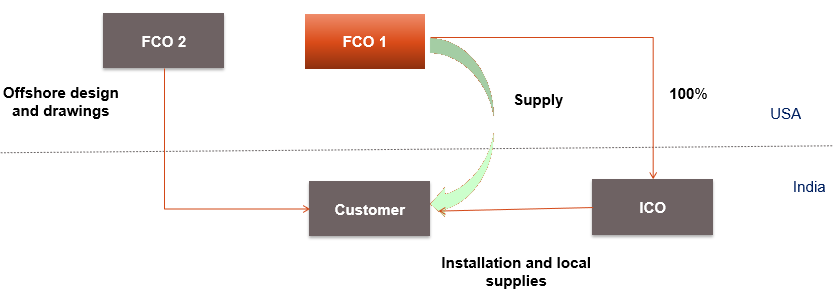

TURNKEY CONTRACTS – ACTIVITIES IN & OUTSIDE INDIA

ARTICLE 7(2) – INDIA USA TREATY

Subject to the provisions of paragraph 3,

where an enterprise of a Contracting State carries on business in the other Contracting State through a permanent establishment situated therein,

there shall in each Contracting State be attributed to that permanent establishment

the profits which it might be expected to make if it were a

distinct and independent enterprise

engaged in the same or similar activities

under the same or similar conditions and

dealing wholly at arm’s length

with the enterprise of which it is a permanent establishment and other enterprises controlling, controlled by or subject to the same common control as that enterprise.

In any case where the correct amount of profits attributable to a permanent establishment is incapable of determination or the determination thereof presents exceptional difficulties, the profits attributable to the permanent establishment may be estimated on a reasonable basis. The estimate adopted shall, however, be such that the result shall be in accordance with the principles contained in this Article.

BASIS OF ALLOCATING PROFITS

HOW TO ASCERTAIN PROFITS OF A PE ?

EXAMPLES

JUDICIAL PRECEDENTS ON ATTRIBUTION OF PROFITS

| S.No | Activity | Percentage allocation |

| 1 | Indian agent of Foreign Telecasting companies – Erstwhile Circular No. 742. | For FTC which did not had a branch or PE in India, in initial years, 10% of gross receipts – Current as per normal Rules |

| 2 | Indian PE negotiated contracts for Supply of equipment by foreign parent | 8% of profits from supplies are taxable in India |

| 3 | Foreign commission agent engaged in sourcing of goods for foreign client having a PE in India | 50% of commission |

| 4. | Where Principal activities of a NR, who concludes contract for sale of goods outside India on a principal to pricniap basism are wholly channeled through the agent who is paid an ALP, | Taxable profits limited to profits attributable to agent services.

NO further attribtution, if agent paid an ALP |

| 5. | Manufacturing in India | Indian profits should be more than profits attributable to sale |

JUDICIAL PRECEDENTS ON ATTRIBUTION OF PROFITS

| S.No | Activity | Percentage allocation |

| 1 | Installation activity carried out in India and no specific books of accounts maintained – Hyundai heavy industries | 10% of gross receipts |

| 2 | Use of CRS by Indian PE – Revenue paid to Indian agent 33% of revenue | No income taxable for NR since 33% expense paid to Indian agent was higher than 15% revenue attributable to the PE |

| 3 | Service PE remunerated at ALP – Morgan Stanley’s case | No further attribution under India USA Treaty |

ARTICLE 7(3) – INDIA USA TREATY

In the determination of the profits of a permanent establishment,

there shall be allowed as deductions

expenses which are incurred for the purposes of the business of the permanent establishment,

including a reasonable allocation of executive and general administrative expenses, research and development expenses, interest, and other expenses incurred for the purposes of the enterprise as a whole (or the part thereof which includes the permanent establishment),

whether incurred in the State in which the permanent establishment is situated or elsewhere,

in accordance with the provisions of and subject to the limitations of the taxation laws of that State.

ARTICLE 7(3) – KEY CHARACTERSTICS

What is allowed as a deduction ?

Expenses incurred for the purposes of the business of PE/ reasonable allocation of specified expenses

Which expenses can be reasonably allocated ?

Executive and general administrative expenses, R&D and interest

Are common expenses incurred for whole enterprise included ?

Other expenses incurred for the purposes of the enterprise as a whole (or the part thereof which includes the PE)

Where should the expenses be incurred ?

In the State in which the permanent establishment is situated or elsewhere

Are domestic laws restrictions applicable ?

Deduction shall be in accordance with and subject to local laws limitation

CAN THE FOLLOWING BE CLAIMED AS A DEDUCTION ?

- Rental of the PE office in Source State

- Administrative and Selling expenses

- Interest expenses on loan to purchase PE assets

- Depreciation on assets used for the purpose of PE business

- Expenses incurred prior to the set up of the PE if income is also taxed in hands of the PE

- Head office expenses

ARTICLE 7(3) – HEAD OFFICE EXPENSES

Can HO claim a mark up on expenses?

No, actual expenses are allowable

If the HO lends own funds and charges interest should that be allowed ?

May not be allowed as a deduction

Is it necessary that allocated expenses should lead to direct revenue generation ?

Not necessary for claiming a deduction

Can the HO cross charge cost of development of Intangible ?

Yes, provided used by the PE and no royalty charged later

What basis can general expenses be allocated ?

Turnover/ Gross Profit / Net proceed ratio to that of the Enterprise

ARTICLE 7(3) – INDIA USA TREATY

However, no such deduction shall be allowed in respect of amounts, if any, paid (otherwise than towards reimbursement of actual expenses) by the permanent establishment to the head office of the enterprise or any of its other offices, by way of royalties, fees or other similar payments in return for the use of patents, know-how or other rights, or by way of commission or other charges for specific services performed or for management, or, except in the case of a banking enterprises, by way of interest on moneys lent to the permanent establishment.

Likewise, no account shall be taken, in the determination of the profits of a permanent establishment, for amounts charged (otherwise than toward reimbursement of actual expenses), by the permanent establishment to the head office of the enterprise or any of its other offices, by way of royalties, fees or other similar payments in return for the use of patents, know-how or other rights, or by way of commission or other charges for specific services performed or for management, or, except in the case of a banking enterprise, by way of interest on moneys lent to the head office of the enterprise or any of its other offices.

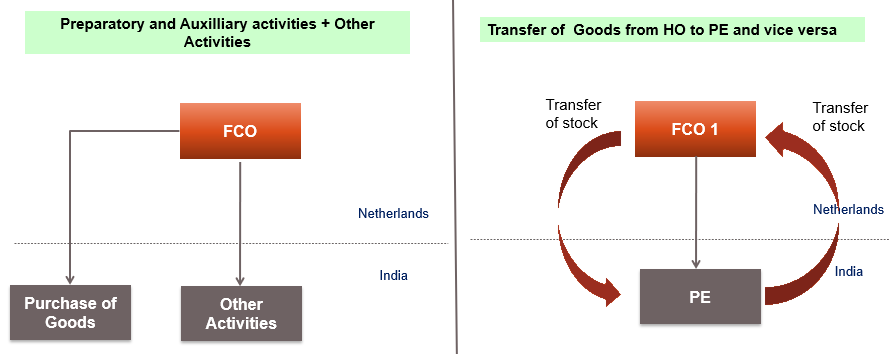

ARTICLE 7(4) – INDIA USA TREATY

No profits shall be attributed to a permanent establishment

by reason of the

mere purchase by that permanent establishment

of goods or merchandise for the enterprise.

ARTICLE 7(5) – INDIA USA TREATY

For the purposes of this Convention,

the profits to be attributed to the permanent establishment as provided in paragraph 1(a) of this Article

shall include

only the profits derived from the assets and activities of the permanent establishment

and shall be determined by the same method year by year unless there is good and sufficient reason to the contrary.

ARTICLE 7(6) – INDIA USA TREATY

Where profits include

items of income which are dealt with separately in other Articles of the Convention,

then the provisions of those Articles shall not be affected by the provisions of this Article.

ARTICLE 7(7) – INDIA USA TREATY

For the purposes of the Convention,

the term “business profits”

means

income derived from any trade or business

including income from the furnishing of services other than included services as defined in Article 12 (Royalties and Fees for Included Services) and

including income from the rental of tangible personal property other than property described in paragraph 3(b) of Article 12 (Royalties and Fees for Included Services)

RULE 10 OF INCOME TAX RULES

If AO is of opinion,

that actual income accruing or arising to any non-resident person whether directly or indirectly cannot be definitely ascertained,

the amount of such income for the purposes of assessment to income-tax may be calculated :

• At such % of turnover, as is considered reasonable by AO;

• Apportioning total profits of business of NR in the Ratio of Indian receipts to total receipts of the business

• such other manner as the AO deems suitable.

SPECIFIC RULINGS

- Supervisory charges for assembly , installation – 3% of contract value – AP Power Generation Corporation

- Composite supply of Hardware and software – Break consideration based on reasonable basis – Raytheon Company

- India China Treaty – No attribution if it can be proved that the activities could not have been undertaken by PE

- German Treaty (1995) – No attribution for equipment machinery supply by HO/ another RP

Learn More about “Double Taxation Avoidance Agreement (DTAA)”