Article 28 – Member of Diplomatic Mission and Consular Posts

ARTICLE 29– INDIA USA TREATY

Nothing in this Convention

shall affect the fiscal privileges

of diplomatic agents or consular offices

under the general rules of international law or

under the provisions of special agreements.

CHARACTERISTICS

- Not related to tax matters

- Provides protection to fiscal privileges of diplomatic agents or consular offices under the general rules of international law

- If provision of DTAA are more beneficial, can opt for them

- No new rights created under Article 28

- Fiscal privilege could be defined under Treaty else meaning in general parlance should apply

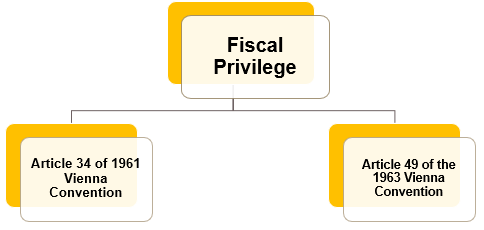

FISCAL PRIVILEGE UNDER INTERNATIONAL LAW

ARTICLE 34 OF 1961 VIENNA CONVENTION – DIPLOMATIC RELATIONS

Learn More about “Article 28 Member of Diplomatic Mission and Consular Posts” – Subscribe International Tax Course

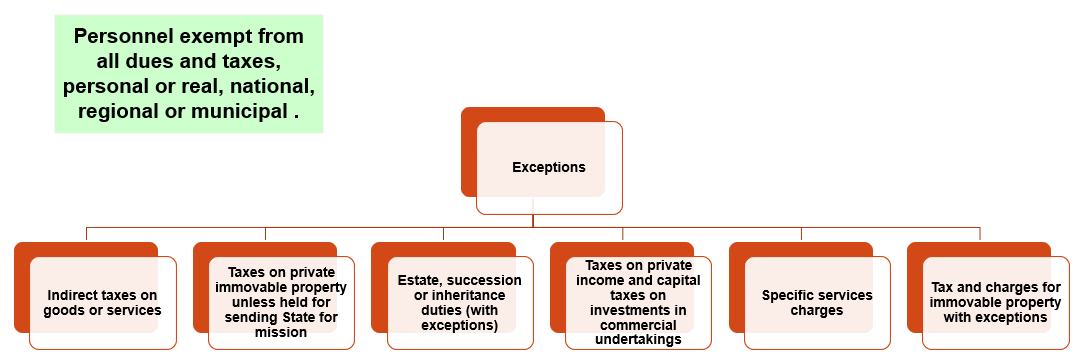

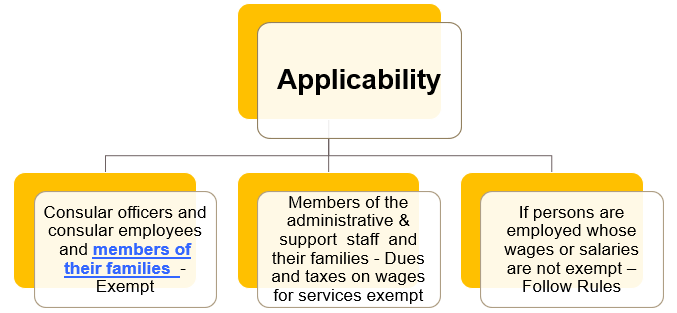

ARTICLE 49 OF THE 1963 VIENNA CONVENTION – WHO ALL ARE EXEMPT ?

ARTICLE 49 OF THE 1963 VIENNA CONVENTION

OTHER POINTS

- Residence to be determined under Domestic laws of contracting states, not Treaty.

- Suitable clause to avoid double non-taxation.

- Exemption available u/s 10(6) to embassy officials/ high commission, consulate , commission or trade representation officials.

- Both salary and pension of the UN employees is exempt from tax in India.

Learn More about “Article 28 Member of Diplomatic Mission and Consular Posts” – Subscribe International Tax Course