DECLARATION OF DIVIDEND

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

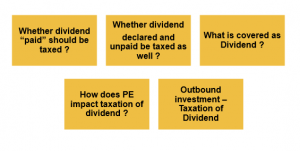

KEY ASPECTS TO BE COVERED

MEANING OF DIVIDEND

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

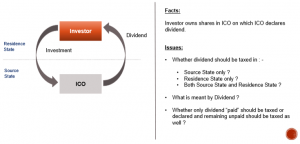

ARTICLE 10(1) OF INDIA USA TREATY – RIGHT TO TAX

Dividends paid by

a company which is a resident of a Contracting State

to a resident of the other Contracting State

may be taxed in that other State

RIGHT TO TAX

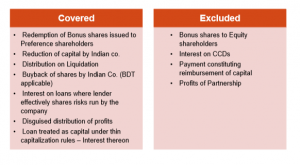

INCLUSIONS

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

EXCLUSIONS

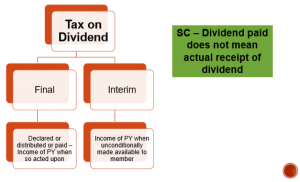

DIVIDEND TAXATION

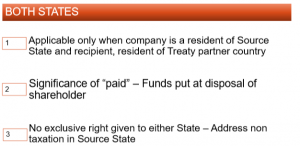

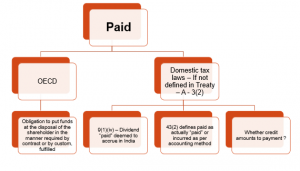

PAID – HOW IT FARES ?

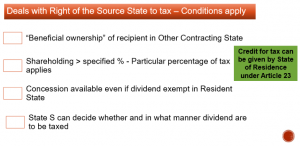

ARTICLE 10(2) OF INDIA USA TREATY – RIGHT OF SOURCE STATE TO TAX DIVIDEND

However, such dividends may also be taxed in the Contracting State of which the company paying the dividends is a resident, and according to the laws of that State,

but if the beneficial owner of the dividends is a resident of the other Contracting State, the tax so charged shall not exceed :

• 15 per cent of the gross amount of the dividends if the beneficial owner is a company which owns at least 10 per cent of the voting stock of the company paying the dividends.

• 25 per cent of the gross amount of the dividends in all other cases.

………..

This paragraph shall not affect the taxation of the company in respect of the profits out of which the dividends are paid

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

SALIENT FEATURES

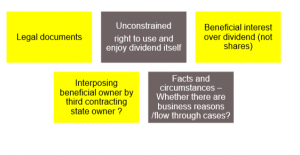

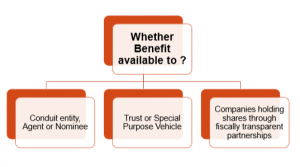

BENEFICIAL OWNERSHIP – NOT DEFINED IN TREATY

TEST OF BENEFICIAL OWNERSHIP ?

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

BENEFICIAL OWNERSHIP

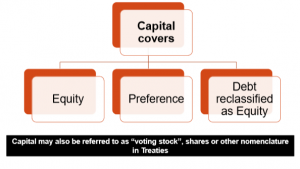

CAPITAL – NO OECD DEFINITION MAKES REFERENCE TO LOCAL COMPANY LAW MANDATORY

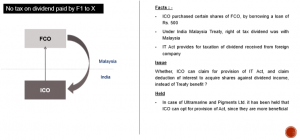

WHETHER TAXPAYER CAN OPT FOR ACT PROVISION INSTEAD OF TREATY ?

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

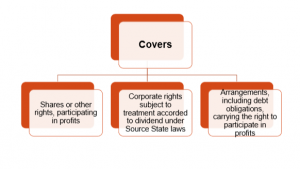

ARTICLE 10(3) OF INDIA USA TREATY – MEANING OF DIVIDEND

The term “dividends” as used in thisArticle means

income from shares or other rights, not being debt-claims, participating in profits,

income from other corporate rights which are subjected to the same taxation treatment as income from shares by the taxation laws of the State of which the company making the distribution is a resident ; and

income from arrangements, including debt obligations, carrying the right to participate in profits, to the extent so characterised under the laws of the Contracting State in which the income arises.

DIVIDEND COVERS

DIVIDEND – WHAT ALL IS COVERED ?

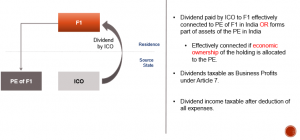

ARTICLE 10(4) OF INDIA USA TREATY – PE OR FIXED BASE

The provisions of paragraphs 1 and 2 shall not apply

if the beneficial owner of the dividends, being a resident of a Contracting State,

carries on business in the other Contracting State, of which the company paying the dividends is a resident, through a permanent establishment situated therein, or performs in that other State independent personal services from a fixed base situated therein, and the dividends are attributable to such permanent establishment or fixed base.

In such case the provisions of Article 7 (Business Profits) or Article 15 (Independent Personal Services), as the case may be, shall apply

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

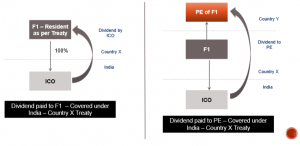

PE SITUATION

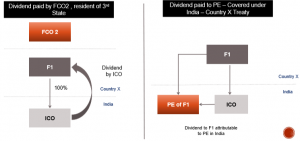

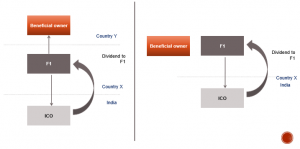

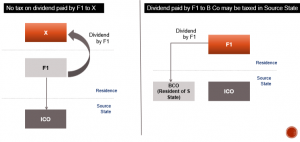

ARTICLE 10(5) – RIGHT TO TAX DIVIDEND DECLARED BY FOREIGN CO DERIVING INCOME FROM OTHER STATE

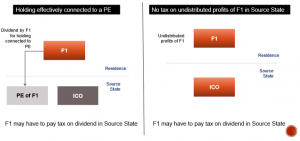

Where a company which is a resident of a Contracting State derives profits or income from the other Contracting State,

that other State may not impose any tax on the dividends paid by the company except insofar as such dividends are paid to a resident of that other State (Case 2)

or insofar as the holding in respect of which the dividends are paid is effectively connected with a permanent establishment or a fixed base situated in that other State, (Case 3)

nor subject the company’s undistributed profits to a tax on the company’s undistributed profits, even if the dividends paid or the undistributed profits consist wholly or partly of profits or income arising in such other State (Case 4)

CASE 1 AND 2 – F1 DERIVES INCOME FROM SOURCE STATE

CASE 3 AND 4

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

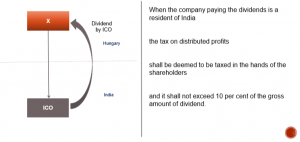

INDIA HUNGARY TREATY – PROTOCOL