CA Final Transfer Pricing Case Studies on International Taxation by CA Arinjay Jain Sir for November 2020, which help to practice questions related to CA Final International Taxation Elective Paper 6C.

CASE STUDY 1 – TRANSFER PRICING – APPLICABILITY OF BASE EROSION CONCEPT

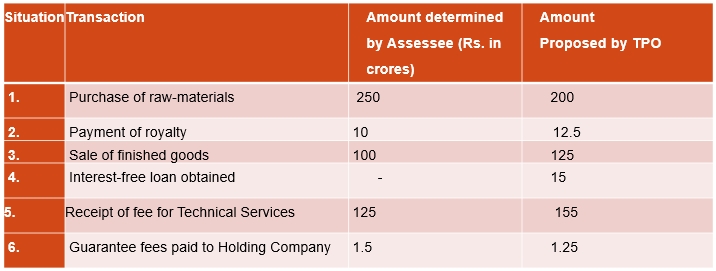

The case of Alpha Inc. was picked for scrutiny assessment u/s 143(2). Given the large number of international transaction, the AO referred the case to the Transfer Pricing Officer to determine the arm’s length price. Keeping in mind the provisions of Base Erosion, you are required to comment whether the following adjustments proposed by the Transfer Pricing officer can be validly made : –

Solution

CASE STUDY 2 – TRANSFER PRICING – WHETHER TWO ENTERPRISE ARE ASSOCIATED ENTERPRISE?

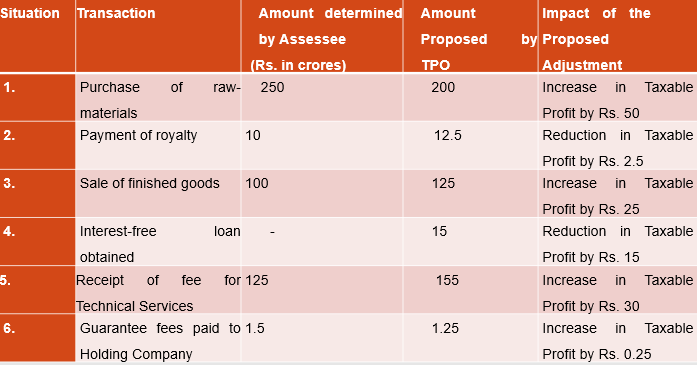

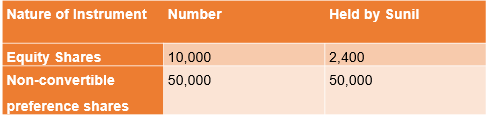

(a) Based on the following data, you are required to ascertain whether Chappel Inc., and Hetal India Private Limited, are Associated Enterprises, in respect of each of these criterion (assume each one of them on a standalone basis): –

(b) Which transaction will be covered under the Transfer Pricing provisions, if Chapell Inc. held 30% of the equity share capital of Hetal India?

Solution

(a) The various criterion, and whether Hetal India or Chappel Inc, would be considered as AE’s are discussed as under: –

- Since Hetal India or Chappel Inc, does not have more than 26% equity share capital of Chappel Inc. (24%) or vice versa (23%), the two parties would not be considered as AE’s;

- Since, Chappel Inc has advanced loan of 40% (200/500*100) % = 40%) of book value of total assets to Hetal India, the two parties would not be considered as AE’s ;

- Since, Chappel Inc. has guaranteed less than 10% of the total borrowings (i.e. 30/ 500 = 6%) of Hetal India, the two parties would not be considered as AE’s ;

- Hetal India or Chappel Inc would not be treated as AE, as 90% or more of raw materials and consumables, required for the manufacture by ICO, are not supplied by Chappel Inc (Rs. 320/Rs. 400*100) = 80%. The total cost of raw material of Hetal India is 80% of Rs. 500 crores = Rs. 400 crores

- Since, Hetal India has made appointment of less than 50% of Board of Directors of Chappel Inc (4/10 = 40%) , the two enterprise would not be considered as Associated enterprise. Similarly, since, Chappel Inc has made appointment of less than 50% of Board of Directors of Hetal India (3/8 = 37.5 %) , the two enterprise would not be considered as Associated enterprise.

(b) If Chappel Inc,, has more than 26% equity share capital of Hetal India the two parties would be considered as AE’s , and all the transaction between them would be covered under the Transfer pricing provisions.

CASE STUDY 3 – TRANSFER PRICING – Penalties under Transfer Pricing

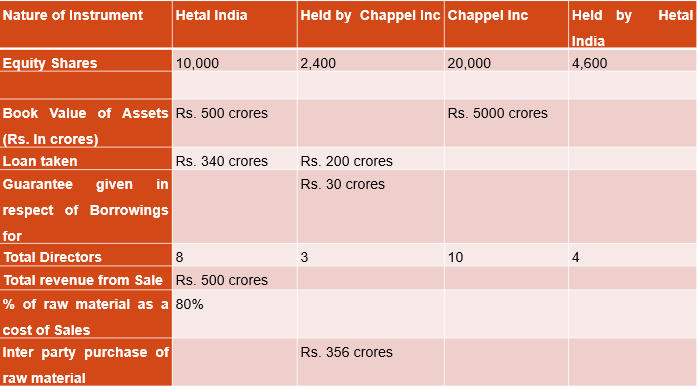

Fulcrum India Private Ltd., is an Indian company in which Sunil holds following shareholding : –

During financial year 2018-19, Fulcrum India paid a remuneration of Rs. 5 crores to Sunil, who is a non-resident. Fulcrum India failed to report the above transaction in its Transfer Pricing filing. What will be the amount of penalty which shall be leviable on account of this default ?

Solution

Two persons would be treated as Associated Enterprises, where one person holds, directly or indirectly, shares carrying 26% or more of the voting power in the other enterprise . In the present case, since Sunil holds 24% equity share capital of Fulcrum India Private Ltd. and 100% non-convertible preference shares, it cannot be said that Sunil holds 26% or more of the voting power in Fulcrum.In view of this,the two parties would parties not be considered as AE’s, and accordingly this transaction would be outside the purview of Transfer Pricing. In view of this, no penalty shall be levied on Fulcrum India Private Ltd .

Similar to the question above, the students can get the problem in the examination , where they may be asked to quantify the penalty applicable for non-compliance of Transfer Pricing provisions. In every such problem the following approach should be adopted : –

(a) Ascertain whether the parties involved in the transaction are Associated Enterprises ?

(b) Ascertain, whether there is any default /delay in complying with the Transfer Pricing provisions ?

(c) If the answer to both the above question is Yes, quantify the applicable penalties. If the answer to either of the above questions is No, no penalty shall be applicable.

CASE STUDY 4 – TRANSFER PRICING – Non maintenance of TP Document and Data

During the course of proceedings for income escaping assessment, the case of Dolphin Inc., for AY 2015-16 was referred to the Transfer Pricing Officer. The total value of international transaction was Rs. 5 crores, and the TPO served a valid notice on the company to provide the information and documents required to be kept under Section 92D(1) and Section 92D(2). However, the company indicated that since, the time limit for notice u/s 143(2) had expired, it had destroyed, all the documents and information relating to the said year. The Tax officer wants to levy a penalty of Rs. 15 lakhs on the company. Comment whether the action of the Tax officer is justified ?

Solution

Section 271AA empowers the AO to levy a penalty @ 2% of the value of each international transaction on a person, who fails to keep and maintain any such document and information, which are required to be kept, under Section 92D(1) and Section 92D(2). These Section, read with Rule 10D(5) provides that Transfer Pricing information and documents should be kept and maintained for a period of 8 years from the end of relevant assessment year. In the present case, since the requisite document have not been maintained , penalty @ 2% of the value of each international transaction amounting to Rs. 10 lakh (and not Rs. 15 lakhs proposed by the AO) can be levied by the AO.

CASE STUDY 5 – TRANSFER PRICING – Secondary Adjustment

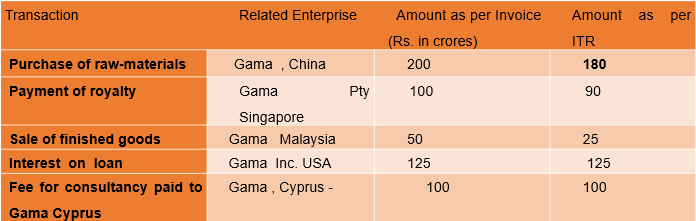

Gama Ltd., an Indian company, has provided you the following information for year ended 31.3.2019 : –

You are also provided the following further information : –

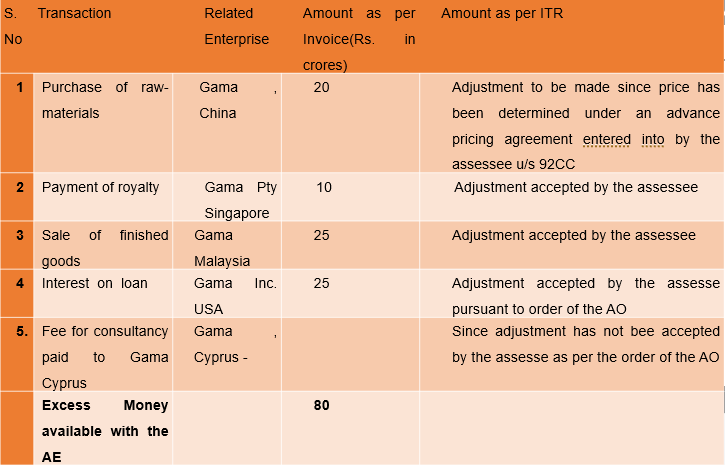

During the course of assessment, the interest paid to Gama Inc. USA who was reduced by the AO to Rs. 100 crores. This adjustment was accepted by the company.

During the course of assessment, Fee for consultancy paid to Gama Cyprus who was reduced by the AO to Rs. 80 crores. This adjustment was not accepted by the company , and it preferred in appeal with the CIT(A) on this matter.

The company, entered into an Advance Pricing Agreement u/s 92CC , wherein, the purchase of raw-materials was agreed at Rs. 180 crores with the relevant authority ;

(a) Compute the amount of any secondary adjustment, which is required to made under Income-tax Act, 1961 for A.Y. 2020-21 , assuming a rate of interest of 11%, and that the transactions materialized on 31.3.2019 ?

(b) Compute the amount of any secondary adjustment, in case the CIT (Appeals) reduces the payment for Fee for consultancy paid to Gama Cyprus by Rs. 10 crores, which is accepted by Gama Ltd. , A.Y. 2020-21 assuming a rate of interest of 11%, that the transactions materialized on 31.3.2019, and Gama Ltd. was able to get the excess money back from the AE within the prescribed time to the extent of Rs. 50 crores ?

Solution : –

Section 92CE(i) provides that the assessee shall make secondary adjustment where the primary adjustment to transfer price , exceeding Rs. 1 crore, has been : –

a)Made suomotu by the assessee in his return of income; or

b)Made by the Assessing Officer and has been accepted by the assessee; or

c)Determined by an advance pricing agreement entered into by the assessee u/s 92CC; or

d)Made as per the safe harbour rules framed u/s 92CB; or

e)Arises as a result of resolution of an assessment by way of the mutual agreement procedure.

In view of the above, the excess money available with the AE shall be computed as under : –

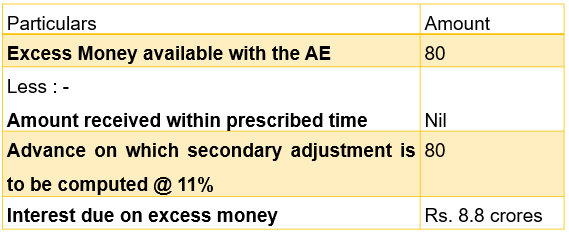

Solution

(a)

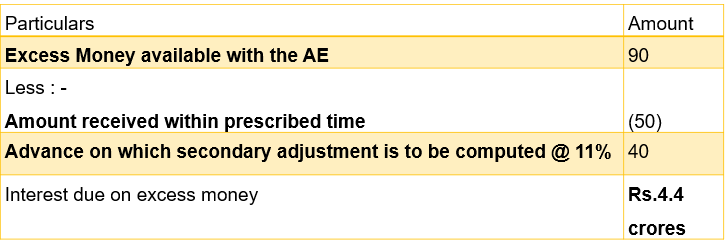

(b) If CIT (Appeals) reduces the payment for Fee for consultancy paid to Gama Cyprus by Rs. 10 crores, which is accepted by Gama Ltd., the excess money available with the AE would be 90 crores.

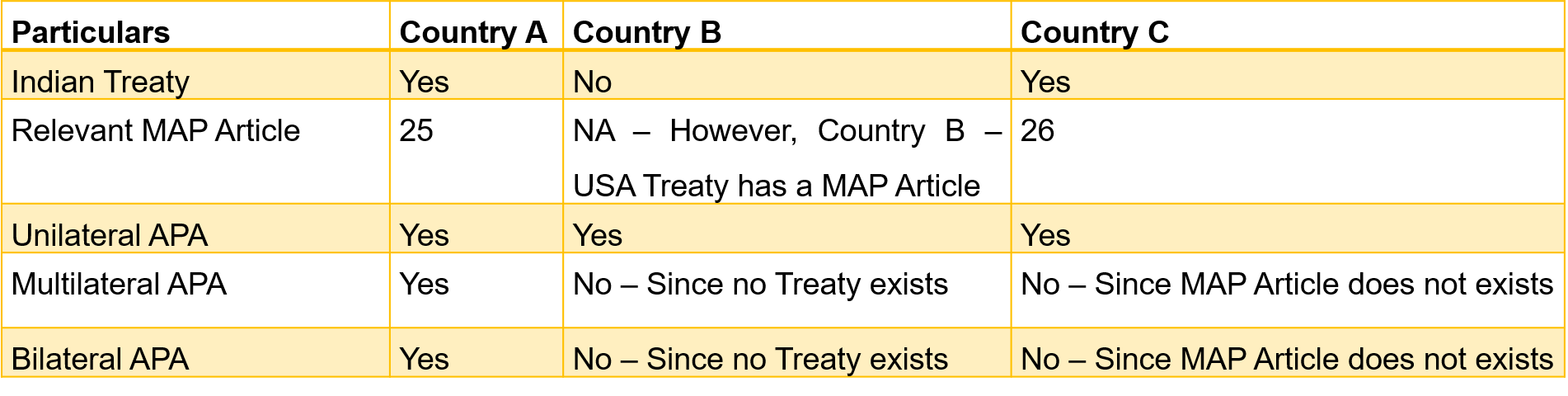

CASE STUDY 6 – TRANSFER PRICING – Cost Plus Method

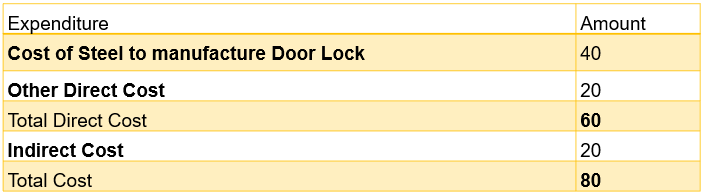

Doorlock India is a company incorporated under the Companies Act, 2013, a wholly owned subsidiary of Doorlock USA, and has a factory in Haryana. It is engaged in manufacture of door locks , door handle and other security product. Amongst several other products, the company manufactures, Category A door lock for which the details are as under : –

During FY 2018-19, it sold 5,00,000 pieces of such locks toDoorlockUSA @ Rs.100 per lock (including transportation cost). There were following differences which were available between sale of Category A door lock to third party buyers (included in the above cost ) : –

a)Third parties require affixing their Logo on the Locks for which indirect cost of Rs. 2 per lock is incurred.

b)Credit period of 6 months is given to third parties while sale to Doorlock USA is on advance basis. The credit cost can be assumed at 0.5% per month of Direct Cost of the Product

c)Goods are sold and delivered to Doorlock USA at their warehouse while in case of third parties, goods are delievered at the Godown of seller. Additional transportation cost is Rs. 10 per unit. Assume there is no mark up on freight charged by company.

Compute the arm’s length price, assuming a margin of 25% on Cost is earned from unrelated parties.

Solution

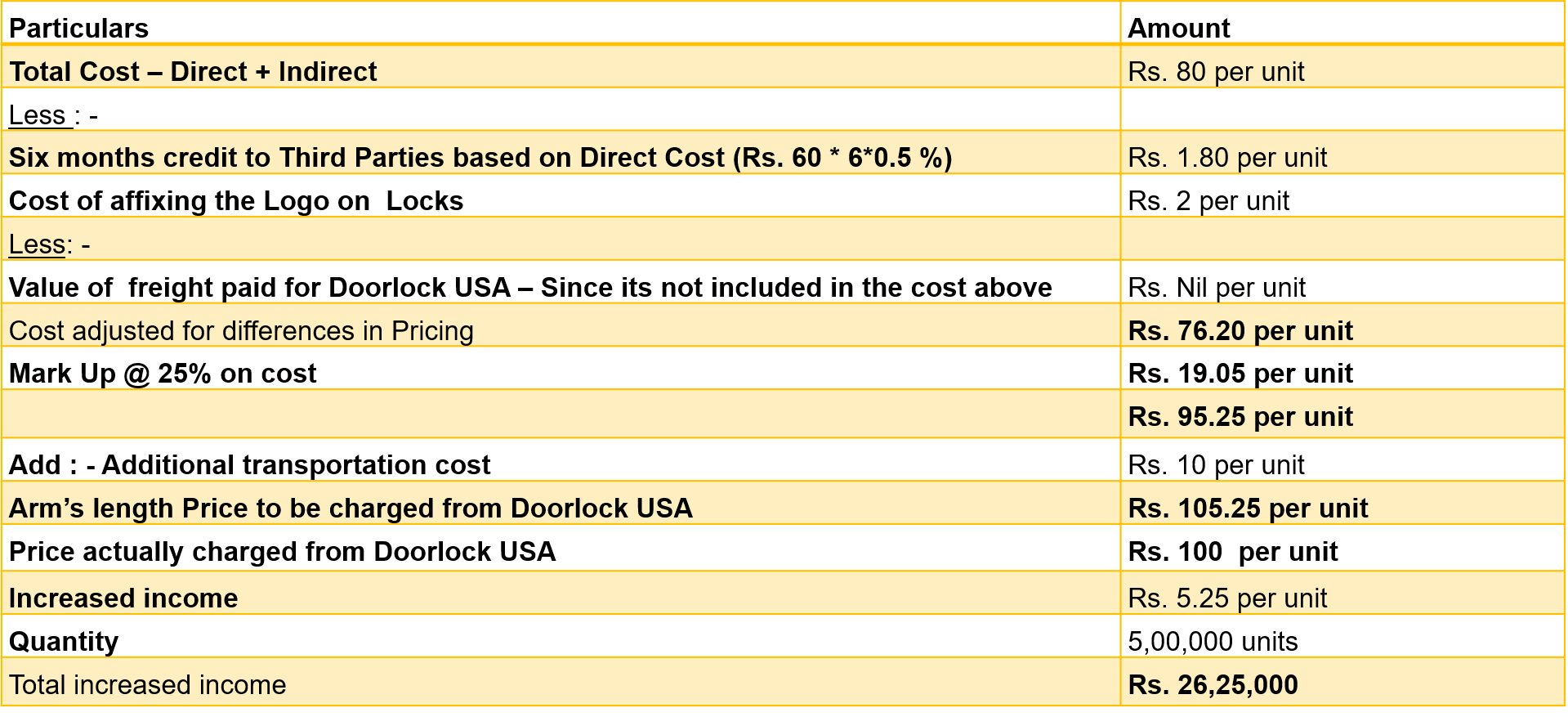

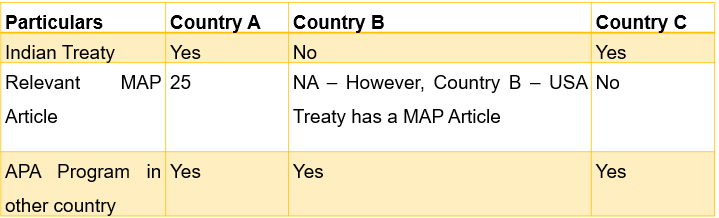

CASE STUDY 7 – TRANSFER PRICING – APA

Identify which of the APA can be entered into in the following cases : –

Solution – Request for bilateral or multilateral APA can be accepted by the Indian competent authority , where the following conditions are satisfied : –

a)India has a tax treaty (i.e., DTAA) with the Other Contracting State,

b)Such DTAA has an Article on ‘Mutual Agreement Procedure’ (MAP);

c)The other country also has a corresponding APA program

If these conditions are not satisfied, the BILATERAL OR Multilateral APA cannot be entered into. However, the taxpayer can still out for a unilateral APA.

CASE STUDY 8 – TRANSFER PRICING – Notified Jurisdictional Area

CBDT has notified Country A as NJA u/s 94A on April 01, 2017 due to lack of effective exchange of tax information with India. On August 01, 2017, X Ltd. has received a loan of Rs. 10,00,000 @10% per annum from Y LLC., who is resident of Country A. However, based on mutual agreement on September 1, 2017, India and Country A, decided that Country A would not be a NJA. As per the terms of the loan agreement , interest on loan was to accrue for the first time on 31.3.2018. Assuming the rate of TDS on such interest under the treaty between India and Country A is 10%, what would be the rate at which that shall be withheld ?

Solution

As per the provision of section 94A , the rate of TDS in respect of any payment made to a person located in the NJA, on which tax is deductible at source, will be the higher of the following rates –

- Rates specified in the relevant provision of the Income-tax Act, 1961 – 40% ; or

- Rate or rates in force – 10% as per the Treaty ; or

- 30%.

Accordingly, the amount of TDS shall be Rs. 40,000 as per normal provision of the Income Tax Act, 1961. However, However, given that the two countries agreed that Country A shall no longer be an NJA, Y LLC., would be entitled to the benefit of the India – Country A Treaty and accordingly, the amount of taxes to be withheld shall be Rs. 10,000.

CASE STUDY 9 – TRANSFER PRICING – Applicability of Transfer Pricing AND Base Erosion

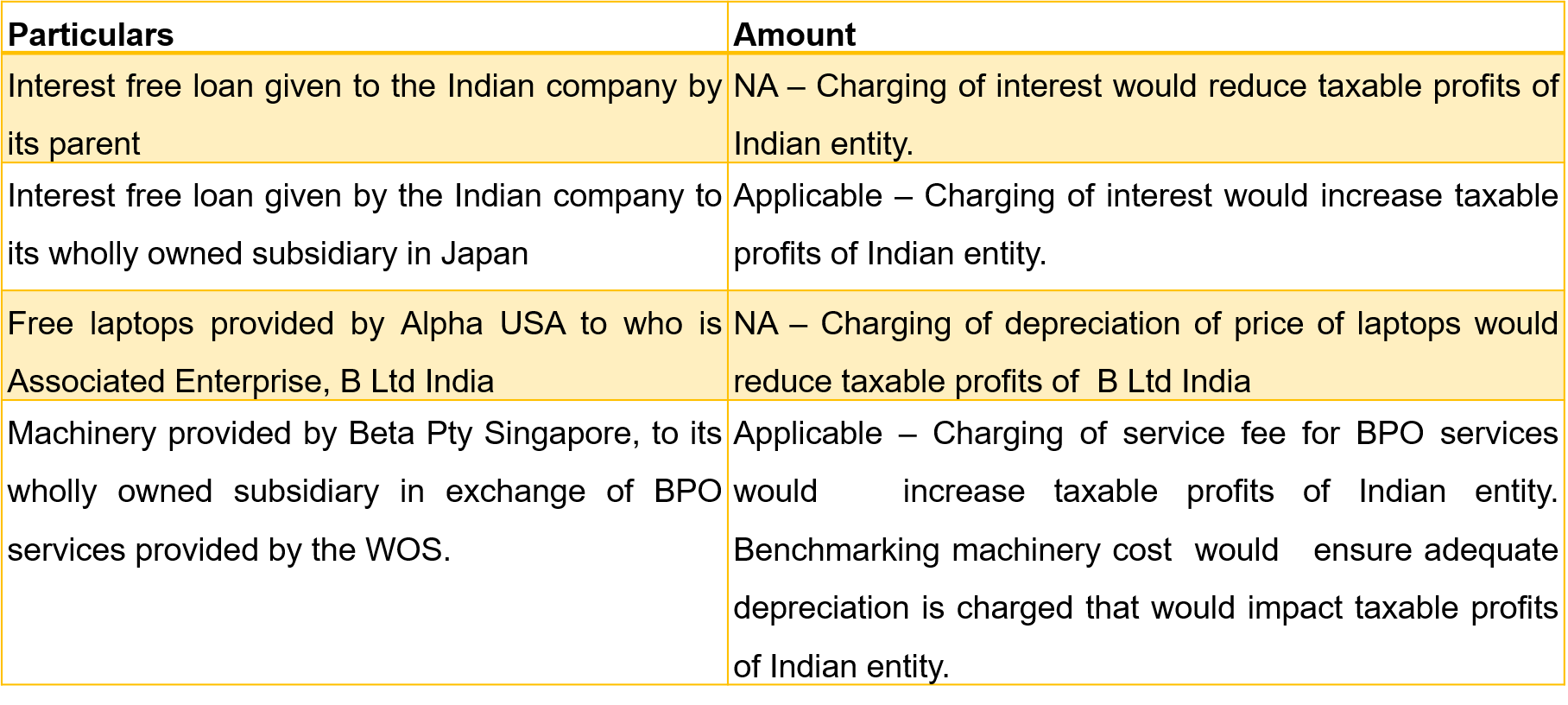

Identify whether transfer pricing provisions would be applicable on the following transactions : –

- Interest free loan given to the Indian company by its parent

- Interest free loan given by the Indian company to its wholly owned subsidiary in Japan

- Free laptops provided by Alpha USA to who is Associated Enterprise, B Ltd India

- Machinery provided by Beta Pty Singapore, to its wholly owned subsidiary in exchange of BPO services provided by the WOS.

Solution

Transfer Pricing regulations are designed to prevent shifting of profits, by manipulating prices charged by overseas entity or paid by Indian entity in international transactions, thereby eroding the country’s tax base. However in certain cases, application of the Transfer Pricing provisions, may result in reduction of profits taxable in India or increase the expenses, allowable as a deduction for Indian tax purposes. In such cases, Transfer Pricing provision are not required to be applied where the adoption of the arm’s length price would result in a decrease in the overall tax incidence in India in respect of the parties involved in the international transaction. In view of this, the specific comments are as under : –

CASE STUDY 10 – TRANSFER PRICING – Full Length Question

Amar P Ltd., Bangalore is engaged in IT Enabled services. It is the subsidiary of ABC Inc in US. It also provides similar services to a company SAK Ltd. at Singapore. Its billings and other information is as given here under:

i. Billings per month to ABC Inc. – USD 85000

ii. Billings per month to SAK Ltd. – USD 70000

iii. ABC Inc has provided a loan of USD 100000 to Amar P Ltd. towards purchase of hardware for executing its project. Rate of interest charged for the said loan is at 3%p.a.

iv. DirectandindirectcostincurredareUSD100andUSD200perhour,respectively.

v. Amar P Ltd. works 9 hours per day for 15 days to execute the projects for ABC Inc and 8 hours per day for 15 days to execute projects for SAK Ltd. Service was provided by the company to both its customers throughout the year.

vi. Warranty was provided to SAK Ltd. for a period of 2 years. Cost of warranty is calculated at 1% of direct cost incurred. The cost of warranty is neither included in the direct nor indirect cost.

Assume conversion rate 1 USD = Rs. 64. Compute Arm’s Length Price as per the cost-plus method and the amount to be added, if any, to the income of Amar P Ltd.

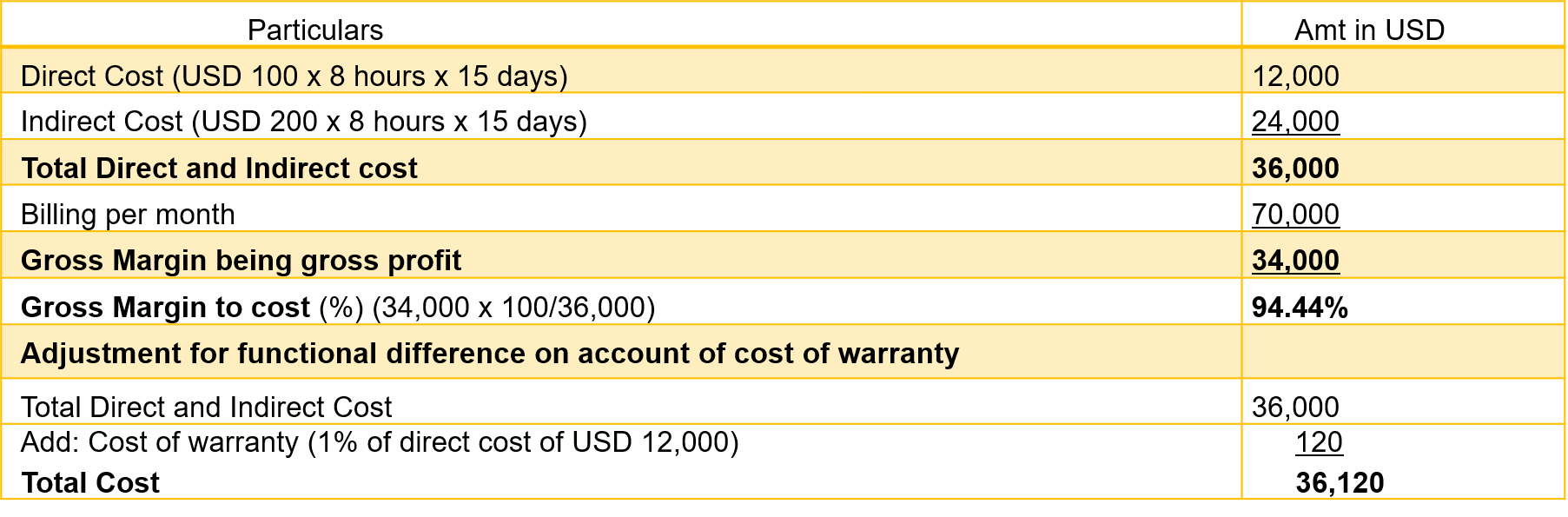

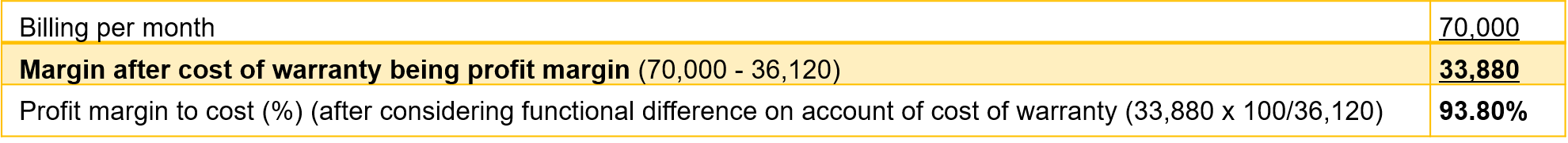

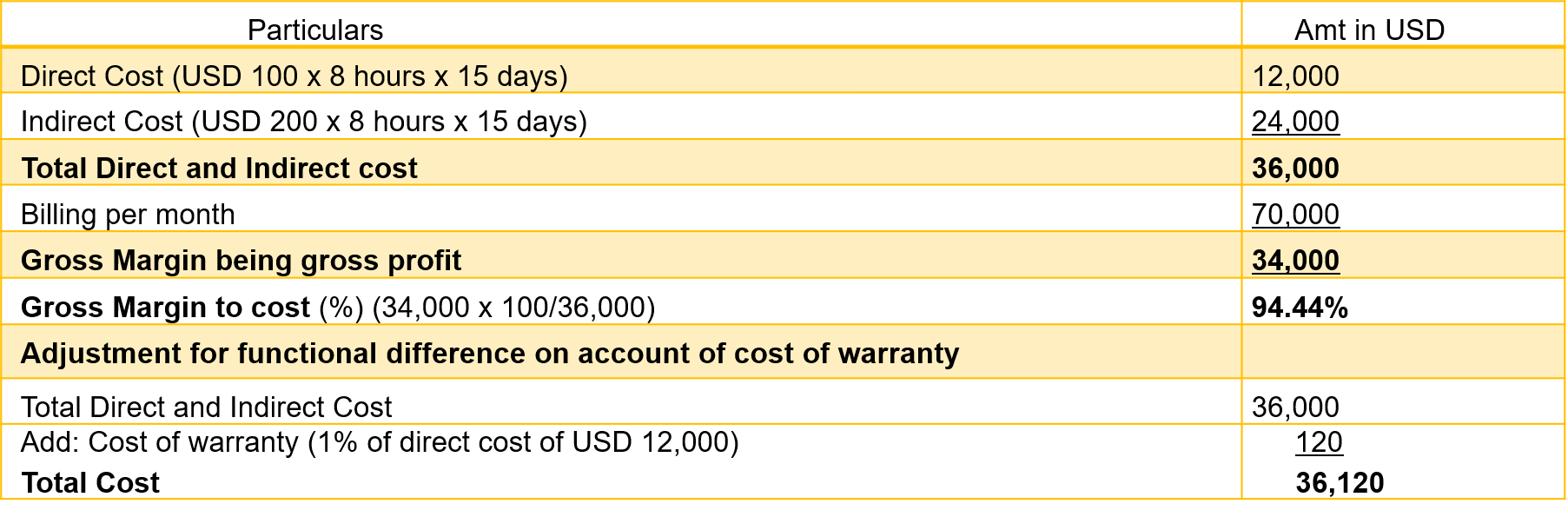

Solution – Determination of Gross Margin of Comparable Uncontrolled transaction i.e., of SAK Ltd.

Computation of Arm’s Length Price by applying Cost Plus Method in case of ABC Inc

In the present case, since actual billing of USD 85,000 per month to the ABC Inc, an AE, is higher than the Arm’s length price of USD 78,974 determined by applying cost plus method, no adjustment is to be made to the income of Amar PLtd.

CASE STUDY 11 – TRANSFER PRICING – Income deemed to accrue or arise in India

Mr. Amar is working as a tax advisor for a law firm based in Lajpat Nagar, Delhi. He has two sons, namely, Akbar and Anthony who both went to Country X in 2010 after completing their LLM from Netherlands based University. Both were appointed as Tax associate in a reputed law firm based in Country X and they never came back to India since then. Mr. Amar has gifted following money in the month of December, 2019 : –

a) He has gifted INR 5,00,000 to one of his son, namely Akbar, residing in Country X

b) He has gifted INR 10,00,000 to Miss Keen residing in Country X , to whom Anthony is getting married. Miss Keen is non-resident for Indian tax purpose during PY 2019-20

c) He has gifted INR 45,000 to his Friend Mr. Amitabh residing in Country X, who is also a non-resident during the PY 2018-19

Mr. Amar has requested you to provide your opinion on the taxability of such gifts in the hands of non-resident recipients of income. Further, which of the aforesaid recipients would be liable to file return of income in India?

Assume that Country X does not have a double-taxation avoidance agreement with India and none of the aforesaid recipients had any Indian sourced income other than gift of money.

Solution

Section 9 of the Income Tax Act (‘the Act’), relates to Income deemed to accrue or arise in India. Under the Act, non–residents are taxable in India in respect of income that accrues or arises in India or is received in India or is deemed to accrue or arise in India or is deemed to be received in India.

Under the existing provisions of the Act, gift of monies exceeding INR 50,000 would be taxed in the hands of recipient, except for certain cases which are covered under exemptions provided in clause (x) of sub-section (2) of section 56.

The Finance Act, 2019 has inserted new clause (viii) of sub-section (1) of Section 9(1) to provide that gift of money exceeding INR 50,000 by a person resident in India to a non-resident shall be deemed to accrue or arise in India.

However, while calculating the aforesaid monetary limit of INR 50,000 any sum of money received from relative shall not be considered. Thus, any receipt of monetary gift by non-resident shall not be taxable in India even if the value money gifted exceeds INR 50,000 during the PY.

Gift of money to Son :- In the present case, the period of stay of Mr. Akbar in India is less than 182 days during the PY 2019-20. Thus, he is non-resident during the PY 2019-20, given the fact that he never visited India since 2010.

Since Mr. Akbar is the son of donor, he is covered within the definition of relative as specified in Section 56(2)(x) of the Act. Accordingly, any receipt of gift by Mr. Akbar would not be deemed to accrue or arise in India. Since, such receipt of gift by Mr. Akbar is not taxable in India and he has no other Indian sourced income, he is not liable to file any income tax return in India for the PY 2019-20.

Gift of money to Miss Keen : –

At the time of gift of money , Miss Keen was not married to Mr. Akbar. Hence she is not the spouse of son of Mr. Amar and accordingly, she is not covered within the definition of relative u/s 56(2)(x) of the Act. Accordingly, receipt of gift by Miss Keen , a non-resident for INR 10,00,000, would be taxable in India. Miss Keen is required to file income tax return in India since her total Indian sourced income exceeds INR 2,50,000.

Gift of money to Friend :-

Since, Mr. Amitabh is not covered within the definition of relative u/s 56(2)(x) of the Act, he is not exempt under the provisions of Section 56. However, since the amount of gift of money does not exceed INR 50,000, such gift would not be taxable in India and accordingly, Mr. Amitabh is not required to file income tax return in India , since he has no other Indian sourced income during the PY 2019-20.

CASE STUDY – TRANSFER PRICING – Presumptive taxation

GGC & CO. is a reputed firm of Chartered Accountant in Gurgaon, dealing in Audit, Direct Taxation, GST, Merger and Acquisition and cross-border taxation, etc. Following clients approached such firm for computation of their income-tax liability and filing of their income-tax return

Mr. A engaged in shipping business

Mr. A, a non-resident, approached such firm for calculation of his income tax and filing of his income tax return in India for the PY 2019-20. He is a tax resident of France and is engaged in the business of operation of ships in International traffic.

He provides following data for filing of his income tax return:-

a) On September 1, 2019, Mr. A collected INR 30 lakhs in California for shipping of goods from Chennai Port to California (It includes demurrage charges of INR 1 lakh and handling charges of INR 2 lakhs)

b) On October 1, 2019, Mr. A collected INR 40 lakhs in India for shipping of goods from port in New York.

c) On October 31, 2019, Mr. A collected INR 50 lakhs in New York for shipping of goods from port in New York to California.

d) He has incurred expenditure of INR 5 lakhs for business purposes in India, out of which INR 50,000 was paid in cash.

e) He also has brought forward business loss of INR 10,000 from trading business in India which was discontinued last year.

f) He has paid LIC insurance premium of INR 50,000 during the PY 2019-20 for insuring the life of his childhood friend.

What would be the tax liability of Mr. A on the basis of Section 44B of the Income Tax Act?

A Inc. engaged in shipping business

A Inc., a non-resident company, engaged in operation of ships in international traffic, which are Chartered from another non-resident company Beta Barbados. During the Previous year 2019-20, it collects following freight from the clients :-

a) On December 1, 2019, it collects INR 20 lakhs in India for shipment of goods from New Zealand Port to Indian port.

b) On December 30, 2019, it collects INR 50 lakhs outside India for shipping of goods from port in India to California.

c) It has incurred expenditure of INR 2 lakhs for business purposes in India.

d) It has also has brought forward business loss of INR 2 lakhs from trading business in India which was discontinued in 2017.

What would be the tax liability of A Inc. on the basis of ad-hoc assessment u/s 172(4) of the Income Tax Act ?

Solution

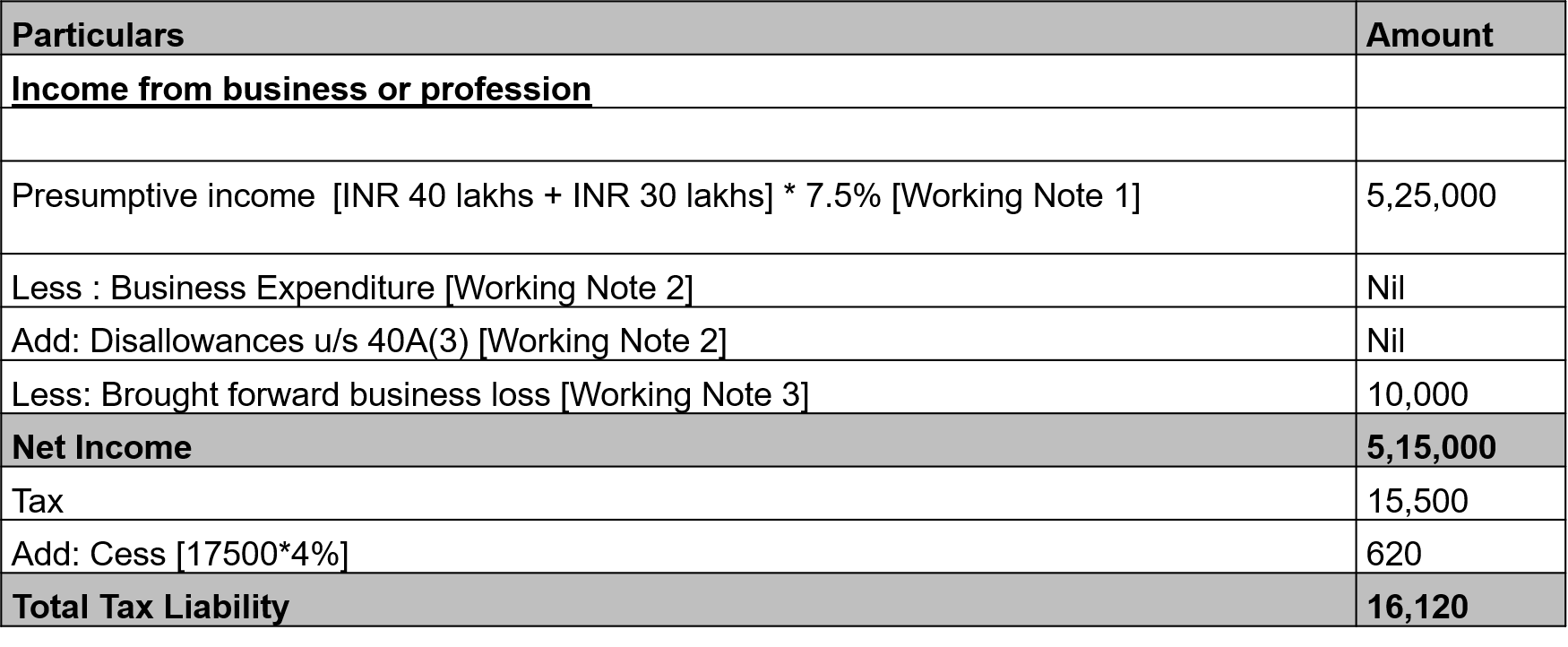

Calculation of income tax liability of Mr. A for the PY 2019-20

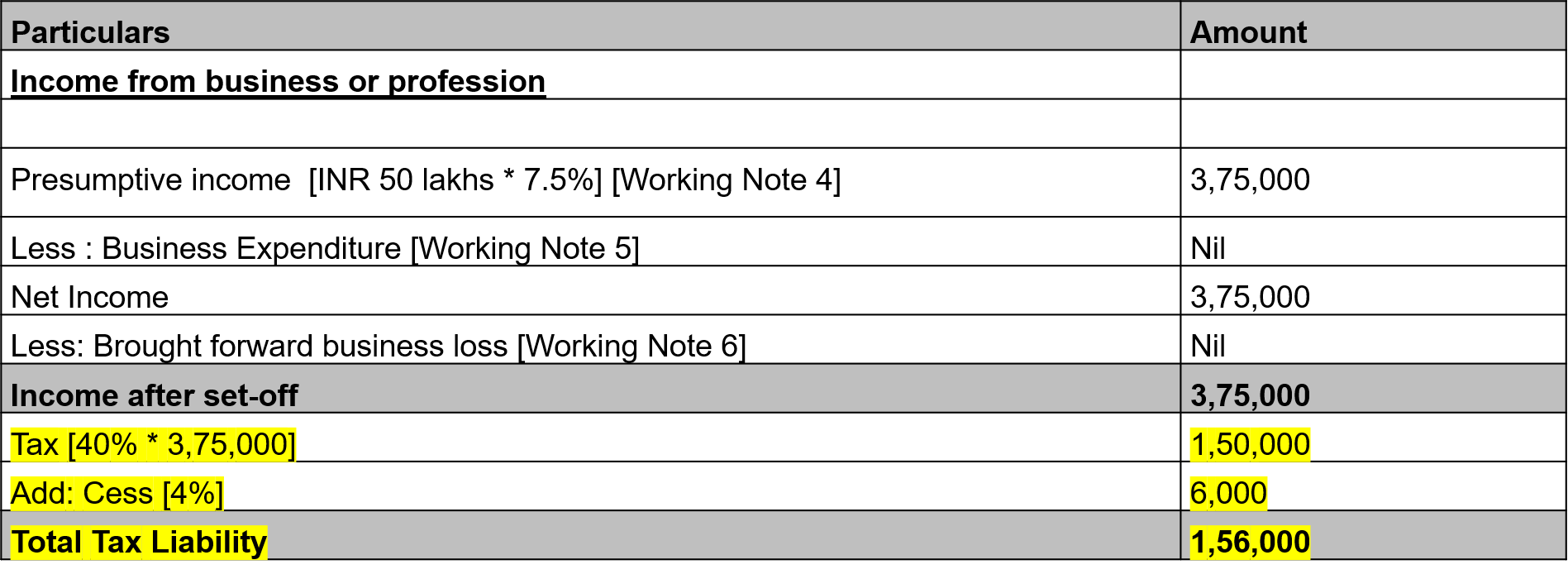

Calculation of income tax liability of A Inc. for the PY 2019-20

CASE STUDY 12 – TRANSFER PRICING – Advance Pricing Agreement

AB India Private Limited was incorporated under Companies Act, 2013, at Mumbai, and is a subsidiary of USA based company AB Inc. It is engaged in providing asset management software, namely, OPAC, to Indian clients. Such software can be used track all physical and digital assets; track inventories, hardware devices, software, and other software. The system also helps in asset lifecycle management.

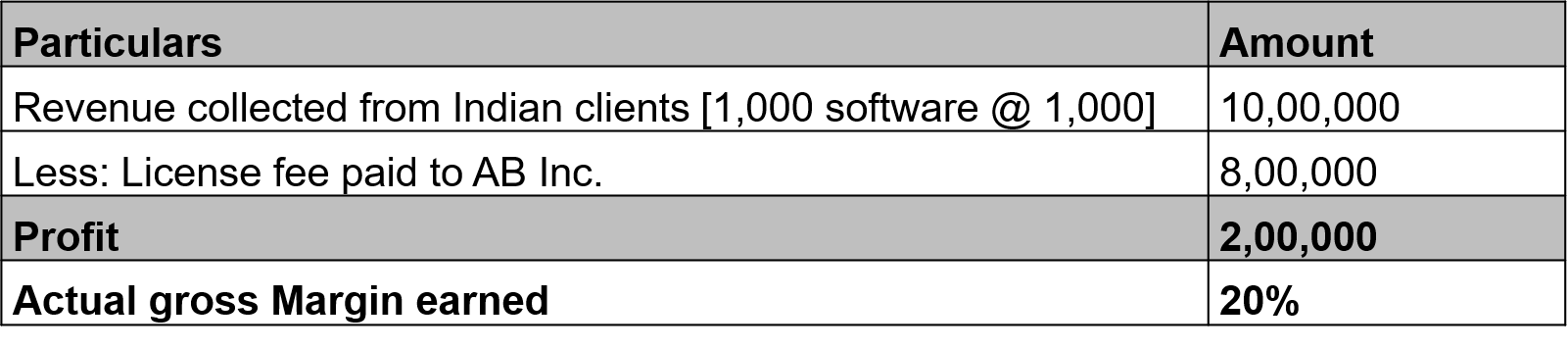

AB India purchases 1,000 software license @ 800 per software from its holding company AB Inc., which is then distributed to Indian customers. AB India pays license fees to AB Inc. as follows :-

AB India filed its income-tax return for PY 2019-20 by treating license fee of INR 8,00,000 paid to its holding company as arm’s length price.

It has computed comparable gross margin as per Resale Price Method as under :-

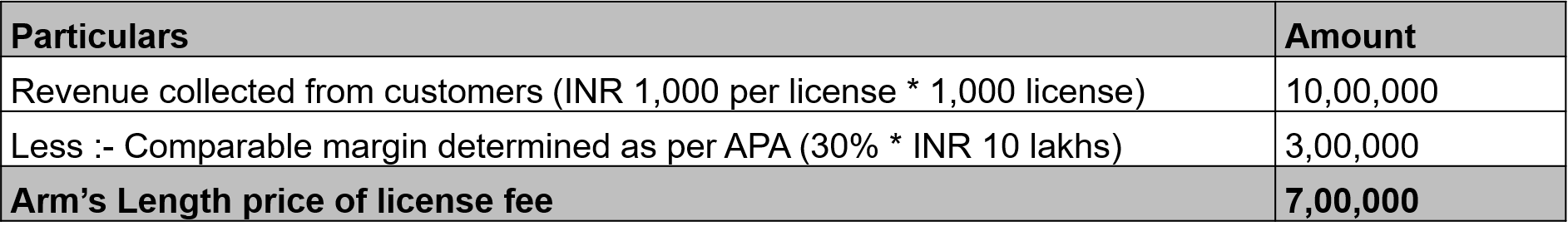

AB India has considered actual license fee as arm’s length price and filed its income tax return for the PY 2019-20. The Assessing Officer has initiated scrutiny assessment for the PY 2019-20. However, in order to buy peace , the taxpayer approached CBDT for concluding unilateral Advance Pricing Agreement. The CBDT has determined comparable margin of 30% under Resale Price Method under the APA as on March 1, 2023. On March 20, 2023 the Assessing Officer has completed the assessment proceedings on the basis of original return filed by the taxpayer for the PY 2019-20. Now the taxpayer has filed modified return as per APA on June 1, 2023.

As a practicing Chartered Accountant, you are required to answer following questions:-

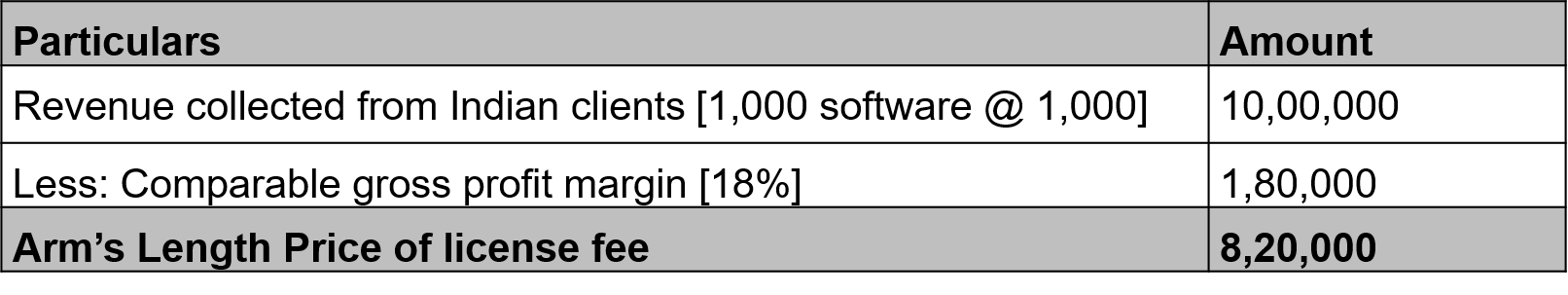

a) What would be the arm’s length price of license fee paid to AB Inc. on the basis of APA entered into with the CBDT?

b) Whether the Assessing Officer can reassess or reopen the entire income tax case for the AY 2020-21 on the basis of modified return filed by the taxpayer? Please justify the stand or action taken by the Assessing Officer.

Solution

(a) Section 92CC of the Act empowers the Central Board of Direct Taxes (CBDT) to enter into an APA, with the approval of the Central Government, with any person for determining the Arm’s Length Price (ALP) or specifying the manner in which ALP is to be determined in relation to an international transaction which is to be entered into by that person.

Thus, once the APA is entered into, the ALP of the international transaction, which is subject matter of the APA, would be determined in accordance with such APA.

The arm’s length price of license fee shall be determined as per APA as under

In the present case, since the payment to non-resident AE is more than ALP determined as per the APA, an addition of Rs. 100,000 shall be made to the taxable income.

(b) In order to give effect to the APA, section 92CD provides the mechanism, including filing of modified return of income by the taxpayer and manner of completion of assessments by the Assessing Officer having regard to terms of the APA.

As per provisions of Section 92CD, the taxpayer is required to file modified return of income within 3 months from the end of the month in which APA has been entered into.

As per the existing provisions of Section 92CD(3), if the assessment or reassessment proceedings for an assessment year have been completed before the expiry of period allowed for furnishing of modified, the Assessing Officer shall, assess or reassess or recompute the total income as per APA.

However, due to the use of words “assess or reassess or recompute”, the Assessing Officer may start fresh assessment or reassessment in respect of completed assessments or reassessments of the assessees who have modified their returns of income as per APA entered into by them. The Finance Act, 2019 has amended Section 92CD(3) to provide that intention of the legislature is for Assessing Officer to merely modify the total income consequent to modification of return of income in pursuance to APA.

It has been provided that where assessment or reassessment has already been completed and modified return of income has been filed by the tax payer, the AO shall pass an order modifying the total income determined in such assessment or reassessment, having regard to and in accordance with the APA.

Accordingly, in this case, the AO cannot recompute or reassess the entire proceedings of AB India for the PY 2019-20 since he can only modify assessment order in respect of the additions of INR 1 lakhs made in modified return.