EFFORTS BY INDIAN GOVERNMENT TO COLLECT TAXES FROM OVERSEAS ASSETS

ARTICLE 28(1) – INDIA POLAND TREATY

The Contracting States shall lend assistance to each other

in the collection of revenue claims.

This assistance is not restricted by Articles 1 and 2.

The competent authorities of the Contracting States may by mutual agreement settle the mode of application of this Article.

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

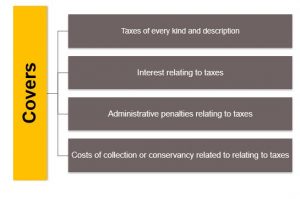

ARTICLE 28(2) – MEANING OF REVENUE CLAIM – INDIA POLAND TREATY

The term “revenue claim” as used in this Article means

an amount owed in respect of taxes of every kind and description

imposed on behalf of the Contracting States, or of their political subdivisions or local authorities,

insofar as the taxation thereunder is not contrary to this Agreement

or any other instrument to which the Contracting States are parties,

as well as interest, administrative penalties and costs of collection or conservancy related to such amount.

REVENUE CLAIMS – CHARACTERSTICS & INCLUSIONS

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

COVERS

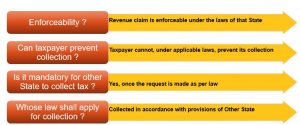

ARTICLE 27(3) – TAX TO BE COLLECTED AS IF IT WERE OWN TAX OF OTHER CS – INDIA POLAND TREATY

When a revenue claim of a Contracting State is enforceable under the laws of that State and is owed by a person who, at that time, cannot, under the laws of that State, prevent its collection,

that revenue claim shall, at the request of the competent authority of that State, be accepted for purposes of collection by the competent authority of the other Contracting State.

That revenue claim shall be collected by that other State in accordance with the provisions of its laws applicable to the enforcement and collection of its own taxes as if the revenue claim were a revenue claim of that other State.

ARTICLE 13(1) – ISSUES FOR CONSIDERATION

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

ARTICLE 28(4) – MEASURE OF CONSERVANCY – INDIA POLAND TREATY

When a revenue claim of a Contracting State is a claim in respect of which that State may, under its law,

take measures of conservancy with a view to ensure its collection,

that revenue claim shall, at the request of the competent authority of that State, be accepted for purposes of taking measures of conservancy by the competent authority of the other Contracting State.

That other State shall take measures of conservancy in respect of that revenue claim in accordance with the provisions of its laws as if the revenue claim were a revenue claim of that other State even if,

at the time when such measures are applied, the revenue claim is not enforceable in the first-mentioned State or is owed by a person who has a right to prevent its collection.

ARTICLE 28(5) – FREEZING OF ASSETS PRIOR TO RAISING A CLAIM – INDIA POLAND TREATY

When a Contracting State, under its law,

takes interim measures of conservancy by freezing assets before a revenue claim is raised against a person,

the competent authority of the other Contracting State, if requested by the competent authority of the first-mentioned State,

shall take interim measures for freezing the assets of that person in that other Contracting State

to the extent permitted in the provisions of its law.

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

ARTICLE 28(6) – PRIORITY OF REVENUE CLAIM INDIA POLAND TREATY

Notwithstanding the provisions of paragraphs 3 and 4, a revenue claim accepted by a Contracting State for purposes of paragraph 3 or 4 shall not, in that State,

be subject to the time limits or

accorded any priority applicable to a revenue claim under the laws of that State by reason of its nature as such.

In addition, a revenue claim accepted by a Contracting State for the purposes of paragraph 3 or 4 shall not, in that State, have any priority applicable to that revenue claim under the laws of the other Contracting State.

ARTICLE 28(7) – PROCEEDINGS BEFORE COURTS – INDIA POLAND TREATY

Proceedings with respect to the existence, validity or the amount of a revenue claim of a Contracting State

shall only be brought before the courts or administrative bodies of that State.

Nothing in this Article shall be construed as creating or providing any right to such proceedings

before any court or administrative body of the other Contracting State.

ARTICLE 28(8) – REVENUE CLAIM CEASES TO EXIST – INDIA POLAND TREATY

Where, at any time after a request has been made by a Contracting State under paragraph 3 or 4 and before the other Contracting State has collected and remitted the relevant revenue claim to the first-mentioned State, the relevant revenue claim ceases to be —

a)in the case of a request under paragraph 3, a revenue claim of the first-mentioned State that is enforceable under the laws of that State and is owed by a person who, at that time, cannot, under the laws of that State, prevent its collection, or

b)in the case of a request under paragraph 4, a revenue claim of the first-mentioned State in respect of which that State may, under its laws, take measures of conservancy with a view to ensure its collection

the competent authority of the first-mentioned State shall promptly notify the competent authority of the other State of that fact and, at the option of the other State, the first-mentioned State shall either suspend or withdraw its request.

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

ARTICLE 28(9) – INDIA POLAND TREATY

In no case shall the provisions of this Article be construed so as to impose on a Contracting State the obligation:

a)to carry out administrative measures at variance with the laws and administrative practice of that or of the other Contracting State;

b)to carry out measures which would be contrary to public policy (ordre public);

c)to provide assistance if the other Contracting State has not pursued all reasonable measures of collection or conservancy, as the case may be, available under its laws or administrative practice;

d)to provide assistance in those cases where the administrative burden for that State is clearly disproportionate to the benefit to be derived by the other