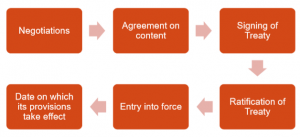

PROCESS OF ENTERING INTO A TREATY

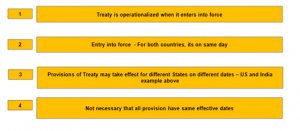

ARTICLE 30(1) OF THE INDIA – US TREATY

Each Contracting State

shall notify the other Contracting State

in writing, through diplomatic channels,

upon the completion of their respective legal procedures

to bring this Convention into force.

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

ARTICLE 30(2) OF THE INDIA – US TREATY

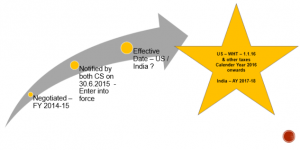

The Convention shall enter into force on the date of the letter of such notifications and its provisions shall have effect : –

(a) in the United States

(i) in respect of taxes withheld at source, for amounts paid or credited on or after the first day of January next following the date on which the Convention enters into force;

(i) in respect of other taxes, for taxable periods beginning on or after the first day of January next following the date on which the Convention enters into force; and

(b) in India, in respect of income arising in any taxable year beginning on or after the first day of April next following the calendar year in which the Convention enters into force.

CASE STUDY

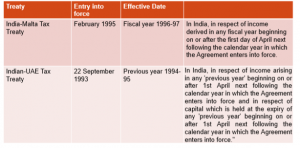

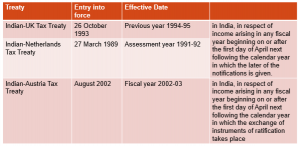

ENTRY INTO FORCE AND EFFECTIVE DATE

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

TREATY CLAUSE

TAXABILITY OF INCOME