SETTING THE CONTEXT

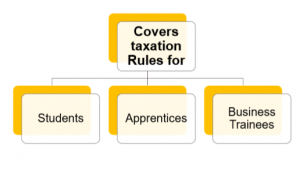

WHAT IS COVERED UNDER ARTICLE 20 ?

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

ARTICLE 20 – INDIA CANADA TREATY

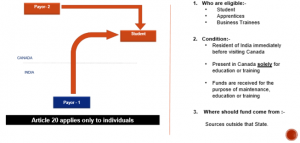

Payments which a student, apprentice or business trainee

who is, or was immediately before visiting a Contracting State,

a resident of the other Contracting State and

who is present in the first-mentioned State solely for the purpose of his education or training receives for the purpose of his maintenance, education or training

shall not be taxed in the first-mentioned State, provided that such payments are made to him from sources outside that State.

CONDITIONS TO CLAIM BENEFIT UNDER ARTICLE 20

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

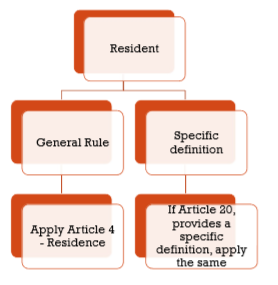

RESIDENT – “IS” OR “ WAS IMMEDIATELY BEFORE VISITING” ?

ARTICLE 20(5)(A) OF THE INDIA- UAE TAX WHO IS RESIDENT ?

For the purposes of this Article and Article 21,—

(a)

(i) an individual shall be deemed to be a resident of India if he is resident in India in the ‘previous year’ in which he visits UAE or in the immediately preceding ‘previous year’ ;

(ii) an individual shall be deemed to be a resident of UAE if, immediately before visiting India, he is a resident of UAE ;

WAS IMMEDIATELY BEFORE, RESIDENT OF OTHER CONTRACTING STATE

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

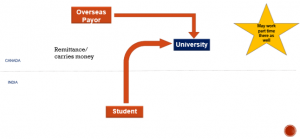

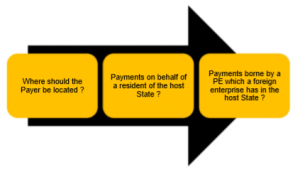

“SOURCES” OUTSIDE THE HOST STATE

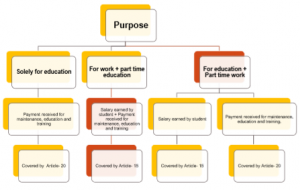

TAXATION & PURPOSE OF VISIT OF STUDENT