ARTICLE 19(1)(A) – INDIA-NETHERLANDS TREATY

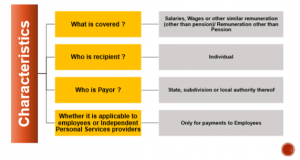

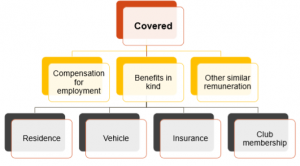

Remuneration, other than a pension

paid by one of the States or a political sub-division or a local authority thereof

to an individual

in respect of services rendered to that State or sub-division or authority

may be taxed in that State

CHARACTERISTICS

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

REMUNERATION PAID TO AN INDIVIDUAL

SALARIES, WAGES AND OTHER SIMILAR REMUNERATION ?

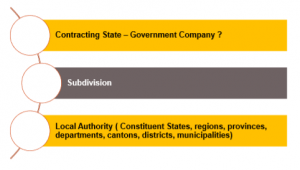

WHO COULD BE THE PAYOR ?

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

GOVERNMENT ORGANIZATIONS COVERED AS PER INDIA – KOREA TREATY

Article 20(4)

The provisions of paragraph (1) of this article shall likewise apply in respect of

remuneration or pensions paid,

in the case of Korea, by the Bank of Korea, the Export-Import Bank of Korea and the Korea Trade Promotion Corporation and

in the case of India, by the Reserve Bank of India and the EXIM Bank of India,

and by organizations recognized by and agreed between the competent authorities of the Contracting States.

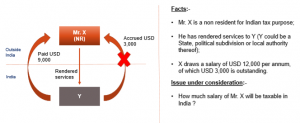

INDIA – JAPAN TREATY – SERVICES RENDERED FOR DISCHARGE OF FUNCTION OF GOVERNMENT NATURE

Remuneration other than a pension,

paid by a Contracting State, or a political sub-division or a local authority thereof,

to an individual;

in respect of services rendered to that Contracting State, or a political sub-division or a local authority thereof, in the discharge of functions of a governmental nature,

shall be taxable only in that Contracting State.

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

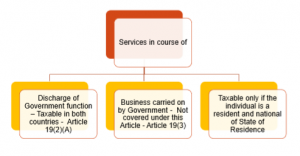

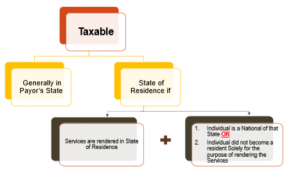

ARTICLE 19(1)(B) INDIA – NETHERLANDS TREATY

However, such remuneration shall be taxable only in the other State

if the services are rendered in that State and

the individual is a resident of that State who:

1. is a national of that State; or

2. did not become a resident of that State solely for the purpose of rendering the services.

TAXABILITY

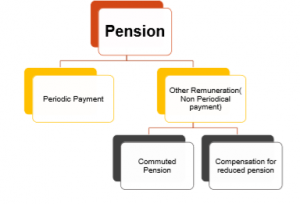

ARTICLE 19(2)(A) – INDIA – NETHERLANDS TREATY

Any pension paid by, or out of funds created by

one of the States or a political sub-division or a local authority thereof

to an individual

in respect of services rendered to that State of sub-division or authority

may be taxed in that State.

MEANING OF PENSION

ARTICLE 19(2)(B) AS PER INDIA – NETHERLANDS TREATY

However, such pension

shall be taxable only in the other State

if the individual is a resident of

and a national of that State

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

ARTICLE 19(3) – INDIA – NETHERLANDS TREATY

The provisions of Articles 15, 16 and 18

shall apply to remuneration and pensions

in respect of services rendered in connection with a business carried on by

one of the States or a political sub-division or a local authority thereof.

SUMMARY OF TAXATION – ARTICLE 19(1)(B)