WHAT IS COVERED BY ARTICLE 17 ?

ARTICLE – 18(1) – INDIA-USA TREATY

Notwithstanding the provisions of Articles 15 (Independent Personal Services) and 16 (Dependent Personal Services)

income derived by a resident of a Contracting State

as an entertainer, such as a theatre, motion picture, radio or television artiste, or a musician, or as an athlete

from his personal activities as such exercised in the other Contracting State

may be taxed in that other State

except where the amount of the net income derived by such entertainer or athlete from such activities (after deduction of all expenses incurred by him in connection with his visit and performance) does not exceed one thousand five hundred United States dollars ($ 1,500);

or its equivalent in Indian rupees for the taxable year concerned.

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

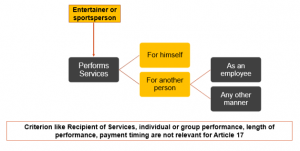

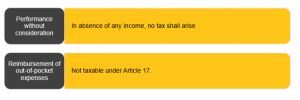

CRITERION OF SERVICES

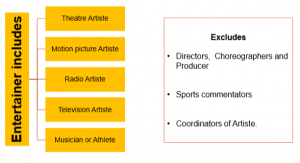

ENTERTAINER – WHO ALL ARE COVERED?

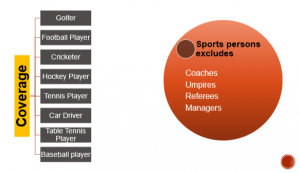

SPORTSPERSON AS AN ENTERTAINER

PERSONAL ACTIVITIES

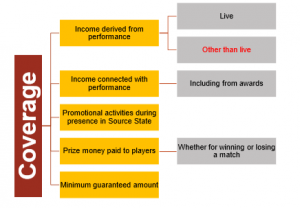

INCOMES COVERED UNDER ARTICLE 17(1)

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

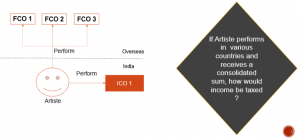

CONSOLIDATED INCOME

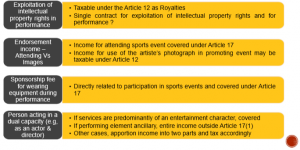

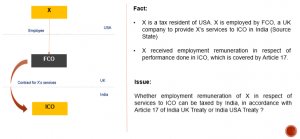

KEY ISSUES

SOME ISSUES

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

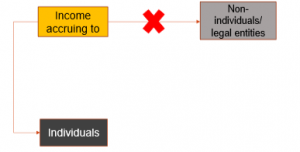

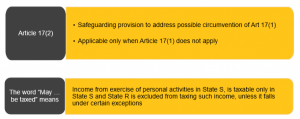

ARTICLE – 18(2) – INDIA-USA TREATY – EQUIVALENT ARTICLE 17(2)

Where income in respect of activities exercised by an entertainer or an athlete in his capacity as such

accrues not to the entertainer or athlete but to another person

that income of that other person may

notwithstanding the provisions of Articles 7 (Business Profits), 15 (Independent Personal Services) and 16 (Dependent Personal Services);

be taxed in the Contracting State in which the activities of the entertainer or athlete are exercised

unless the entertainer, athlete, or other person establishes that

neither the entertainer or athlete nor persons related thereto participate

directly or indirectly in the profits of that other person in any manner

including the receipt of deferred remuneration, bonuses, fees, dividends, partnership distributions, or other distributions.

KEY FEATURES OF ARTICLE 17(2)

TRIANGULAR CASES – WHICH TREATY SHALL APPLY?

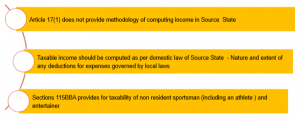

COMPUTATION OF INCOME IN STATE S

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

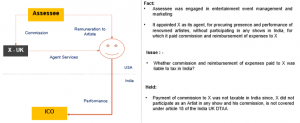

ADIT V WIZCRAFT INTERNATIONAL ENTERTAINMENT (P.) LTD.

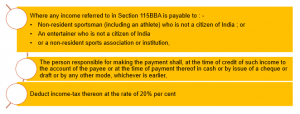

WITHHOLDING TAX IN INDIA