Directors Fees – Article 16 – OECD Model tax Convention

Taxation of Director’s Fees – Article 16

Article 16 – India USA Treaty

Directors’ fees and similar payments

derived by a resident of a Contracting State

in his capacity

as a member of the Board of Directors of a company which is a resident of the other Contracting State

may be taxed in that other State.

Learn More about “Article 16 Directors Fees” – Subscribe International Tax Course

Article 16 – Issue For Consideration

What should be derived ?

Directors’ fees and similar payments

Who should derive ?

Resident of the other Contracting State

In what capacity ?

Member of BOD of a company which is a resident of the other Contracting State

Who has the right to tax ?

India also has the right to tax such income

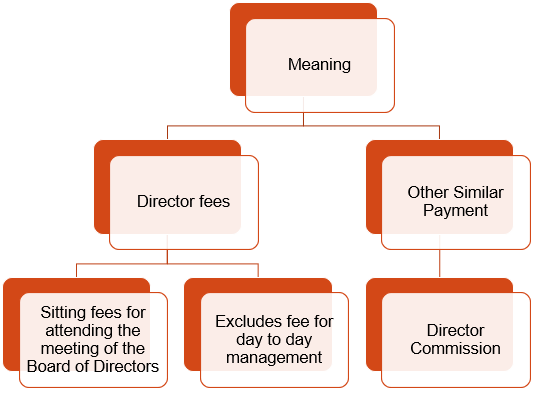

Meaning of Director’s Fees and Other Similar Payments – Article 16

Includes benefits in kind use of residence or vehicle, Stock option, Insurance coverage, Club memberships etc.

Director in Dual Capacity

Fees taxable Article 16 – $ 100

Fees taxable Article 15 – $ 10,000

Fees taxable Article 14 – $ 20,000

Learn More about “Article 16 Directors Fees” – Subscribe International Tax Course

Taxation of Top Level Managerial Remuneration – Directors Fees Article 16 – OECD Model tax Convention

Salaries, wages and other similar remuneration

derived by a resident of a Contracting State

in his capacity as an official in a top-level managerial position

of a company which is a resident of other Contracting State

may be taxed in that other State.

If there are no corresponding provision, income taxable under Dependent or Independent Personal Services clause

Characteristics

Learn More about “Article 16 Directors Fees” – Subscribe International Tax Course