Article 12 – Royalty and Fees for Technical Services

In this presentation we would learn about the taxation of Royalties and Fees for Technical Services, which in some cases is also known as Fee for Included services.

The Model OECD clause Article 12, which deals with Royalty is as under : –

ROYALTIES

1. Royalties arising in a Contracting State and beneficially owned by a resident of the other Contracting State shall be taxable only in that other State.

2. The term “royalties” as used in this Article means payments of any kind received as a consideration for the use of, or the right to use, any copyright of literary, artistic or scientific work including cinematograph films, any patent, trade mark, design or model, plan, secret formula or process, or for information concerning industrial, commercial or scientific experience.

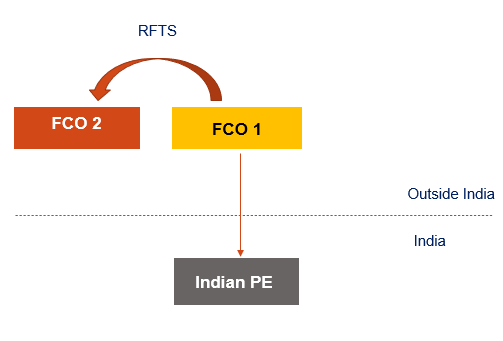

3. The provisions of paragraph 1 shall not apply if the beneficial owner of the royalties, being a resident of a Contracting State, carries on business in the other Contracting State in which the royalties arise through a permanent establishment situated therein and the right or property in respect of which the royalties are paid is effectively connected with such permanent establishment. In such case the provisions of Article 7 shall apply.

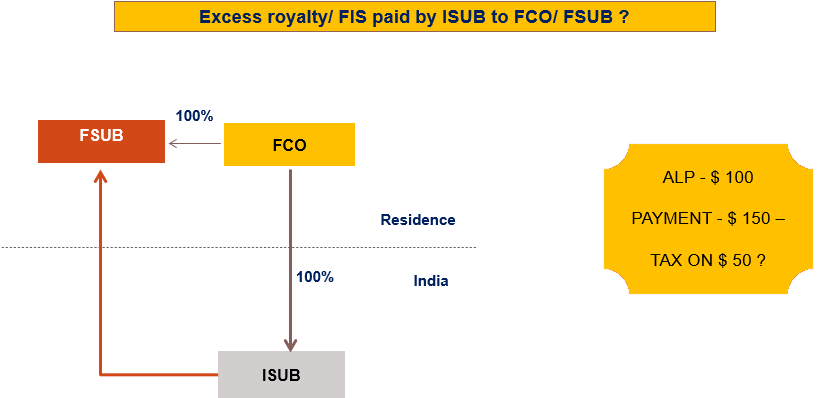

4. Where, by reason of a special relationship between the payer and the beneficial owner or between both of them and some other person, the amount of the royalties, having regard to the use, right or information for which they are paid, exceeds the amount which would have been agreed upon by the payer and the beneficial owner in the absence of such relationship, the provisions of this Article shall apply only to the last-mentioned amount. In such case, the excess part of the payments shall remain taxable according to the laws of each Contracting State, due regard being had to the other provisions of this Convention.

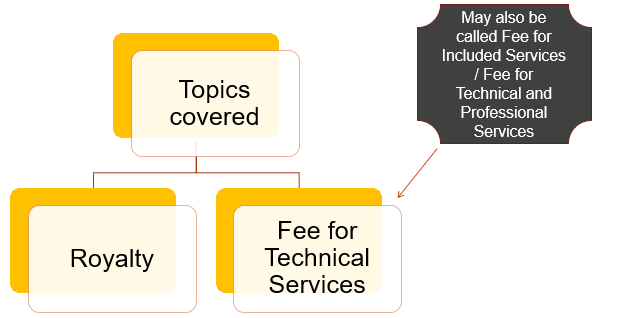

The Topics covered in this note are as under : –

- Royalty

- Fee for Technical Services. It may also be called Fee for Included Services / Fee for Technical and Professional Services

Learn More about “Article 12 – Royalty and Fees for Technical Services” – Subscribe International Tax Course

Key Learning objectives of the Presentation

Some of the key learning objectives of this presentation are as under : –

- How to determine Taxability of royalty under the Income Tax Act & DTAA (Treaty) ?

- Understanding Meaning of Royalties and Fee for Technical Services under the Income Tax Act & DTAA?

- Right of the India (Source State) to tax Royalties/ FTS ?

- Right of the Foreign (Non Resident State) to tax Royalties/ FTS?

- Tax implications if Royalty/FTS is accrued, but not paid ?

- How does existence of Permanent Establishment (“PE”) impact taxation of Royalties/ FTS?

- What if the Royalty/ FTS paid is more than Arm’s length ?

- Case Laws on Royalty and FTS

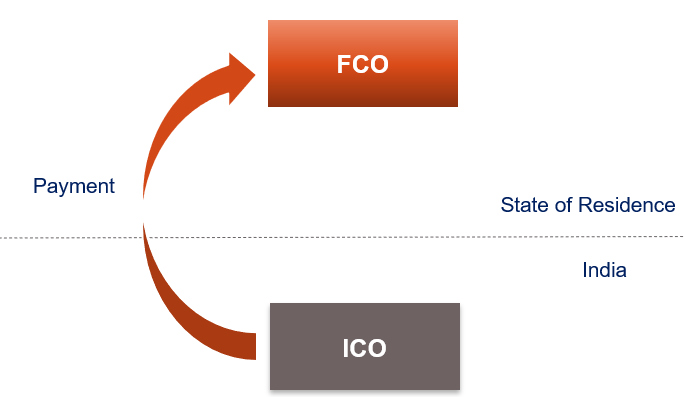

This is graphically represented as under : –

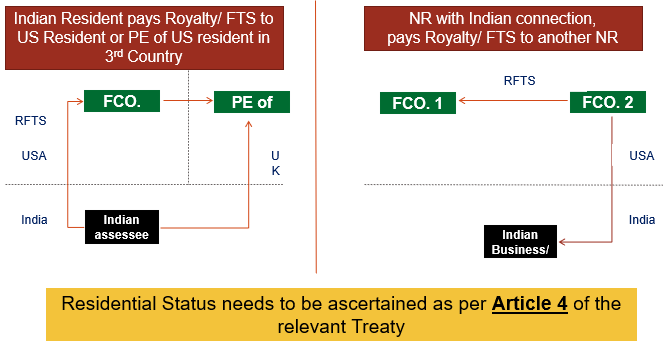

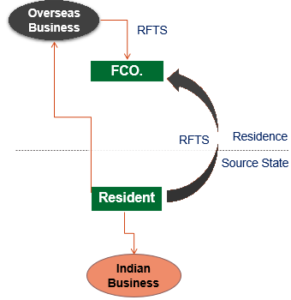

ROYALTY/ FTS – SCENARIO OF TAXABILITY IN INDIA

The taxation of royalty and fee for technical services in India could be evaluated under the following two scenarios : –

- Royalty is paid by an Indian resident to non resident

- Royalty is paid by one non resident to another non resident

The tax implication in both these cases can be diagrammatically represented as under : –

The residential Status needs to be ascertained as per Article 4 – Residence of the relevant Treaty

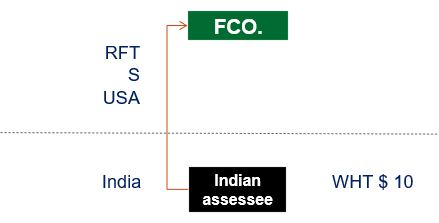

INTER-SE RIGHTS OF INDIA AND OTHER CONTRACTING STATE TO TAX ROYALTY AND FTS

India

- WHT rate is applied as per the Treaty/ Act, on a gross basis, say 10% of $ 100, $ 10;

USA

- Gross amount of $ 100 may be taxed as business income, on a net basis after deduction of expenses ;

- Case A – Expenses $ 80

Since income is $ 20, if US tax rate is 35%,US tax due is $ 7. Since Indian WHT is $ 10, no further tax will be due in USA. - Case B – Expenses $ 60

Since income is $ 40, if tax rate is 35%, US tax due is $ 14. Since WHT is $ 10, $ 4 needs to be paid in USA

- Case A – Expenses $ 80

Set off of losses, carry forward of Foreign Tax Credit shall be as per local US laws/ other Treaty provisions.

Learn More about “Article 12 – Royalty and Fees for Technical Services” – Subscribe International Tax Course

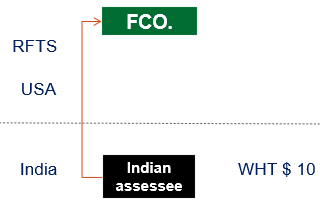

INTER-SE RIGHTS OF INDIA AND OTHER CONTRACTING STATE

India

- WHT rate is applied as per the Treaty/ Act, on a gross basis, say 10% of $ 100, $ 10;

USA

- Gross amount of $ 100 may be taxed as business income, on a net basis after deduction of expenses ;

- Case A – Expenses $ 80

Since income is $ 20, if US tax rate is 35%,US tax due is $ 7. Since Indian WHT is $ 10, no further tax will be due in USA. - Case B – Expenses $ 60

Since income is $ 40, if tax rate is 35%, US tax due is $ 14. Since WHT is $ 10, $ 4 needs to be paid in USA

- Case A – Expenses $ 80

Set off of losses, carry forward of Foreign Tax Credit shall be as per local US laws/ other Treaty provisions.

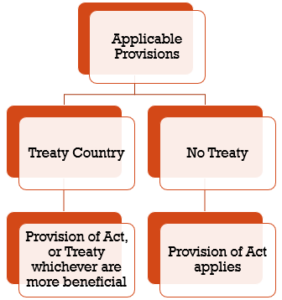

BENEFICIAL PROVISION – TREATY OR ACT , WHICHEVER ARE MORE BENEFICIAL ARE APPLICABLE

The taxation of royalty or Fee for Technical Services, would depend on, whether the country of non resident receiving the same, has a Treaty with India or not ?

In case his country of Residence have a treaty with India, the provision of the Indian Income Tax Act of the Treaty whichever are more beneficial to him would be applicable.

However, in case, his country of Residence does not have a treaty with India, the provision of the Indian Income Tax Act would be applicable.

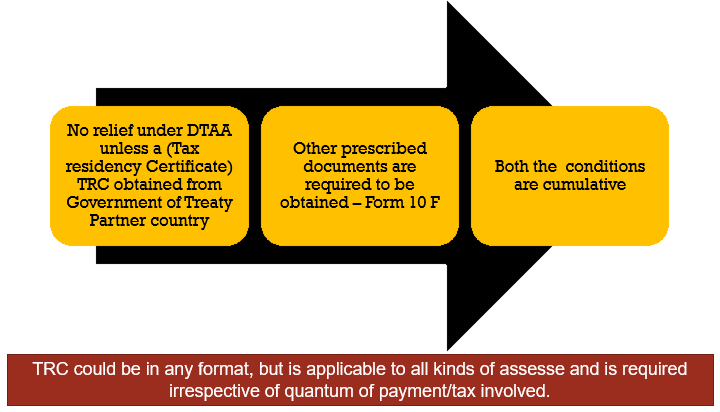

PROOF OF RESIDENCE – SECTION 90(4) & 90(5)

In order to claim Treaty benefits, both the following conditions are required to be satisfied : –

- Recipient would not get any relief under DTAA unless a (Tax residency Certificate) TRC obtained from Government of Treaty Partner country is submitted;

- Other prescribed documents are required to be obtained and provided to the Payor – Form 10 F

TRC could be in any format, but it is applicable to all kinds of assessee and is required , irrespective of quantum of payment/tax involved.

GENERAL CONDITIONS APPLICABLE TO ARTICLE 12

- Unless re-directed by Article 12, even if NR has a PE/ Fixed Base, income covered under Royalty / FTS not taxable under Article 7 – Business Profits read with Article 5 – Permanent Establishment

- Unless re-directed by Article 12, even if NR has a PE/ Fixed Base, income covered under Royalty / FTS not taxable under Article 7 read with Article 5 – Business Profits/PE OR Article 14 – Independent Personal Services

- Only Royalty and Fee for technical Services upto Arm’s length price is taxable under Article 12 . For example, if royalty paid is $ 150 and ALP $ 100 , only $100 would be taxable in the hands of the NR

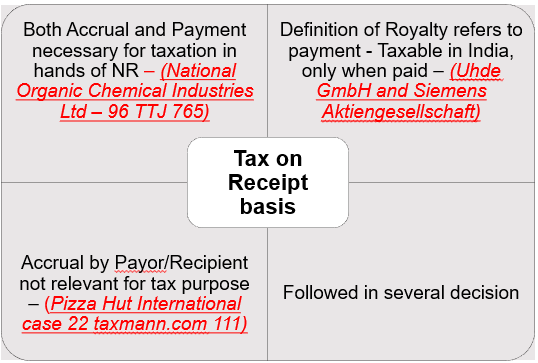

- Taxation in hands of NR may be triggered only when the payment is made

- Taxation in hands of NR may be triggered only when the payment is made, and not when the royalty is accrued in books of the Payor

Learn More about “Article 12 – Royalty and Fees for Technical Services” – Subscribe International Tax Course

APPROACH TO ASCERTAIN TAX IMPLICATIONS ON ROYALTY & FTS

In order to understand the taxability of Royalty and Fee for technical services, one should follow the following steps : –

Step 1 – Evaluate the provision of Income Tax Act, 1961

Whether payment is taxable as Royalty/ FTS – If it is taxable, ascertain the rate of withholding tax . If the payment is not taxable, the payment is not taxable in the hands of the NR

Step 2 – Applicable Tax Treaty

If the scope of Royalty/ FTS in Treaty is narrower, one should opt for the provision of the Treaty. However, if it is also taxable under Treaty, one should check if concessional rate of tax is available under Treaty ?

The provision of the IT Act, 1961 or Treaty, whichever are more beneficial shall apply

TAX RATES FOR ROYALTY AND FTS

There are two sets of Rates for Computing tax on Income by way of Royalties and Fee for Technical Services : –

- Income Tax Act, 1961 – The following rates are available for application under the Income Tax Act, 1961,

Tax on royalties in case of Foreign companies is given under Section 115A of the IT Act, 1961

Special provision for computing Income by way of royalties in case of foreign companies – Section 44D/Non residents – Section 44DA

- Once the provision of the IT Act are analyzed, one should evaluate Article 12/ 13 of the applicable Treaty, , subject to MFN clause.

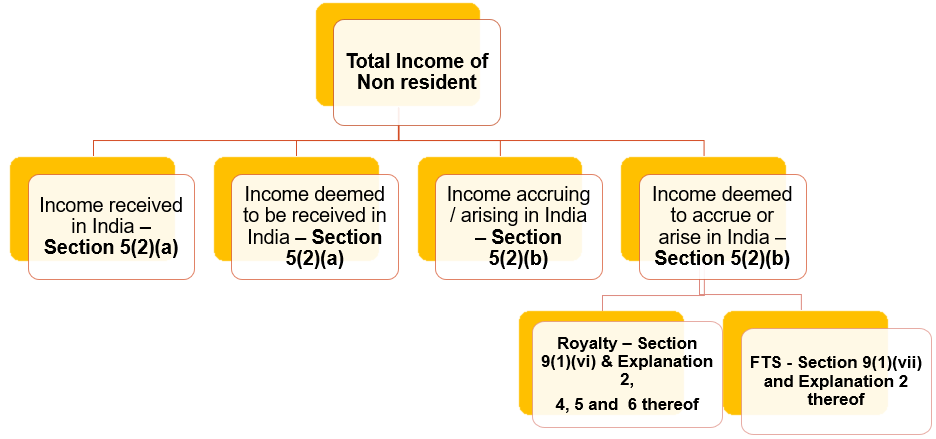

INCOME TAX ACT PROVISION – SECTION 5 & 9

WHICH COUNTRY CAN TAX ROYALTY / FTS ?

SOME ILLUSTRATIVE TREATY PROVISION – ROYALTY

Taxable only in Country of Residence

Royalties arising in a Contracting State and beneficially owned by a resident of the other Contracting State shall be taxable only in that other State

Both India and Other country has right to tax

Royalties arising in a Contracting State and paid to a resident of the other Contracting State may be taxable only in that other State

ROYALTY/ FTS “ARISE” UNDER THE ACT GOVERNMENT PAYMENTS

Always arises in India

ROYALTY/FTS “ARISE” UNDER THE ACT PAYMENTS BY PERSON RESIDENT IN INDIA

- Always arises in India

- Exceptions : –

- Royalty (Bullet 1 to 3) / FTS (Bullet 2 & 3) :-

- Paid for any right/ property or information used for business/ profession outside India.

- Services utilized for business/ profession outside India

- Making or earning any income from any source outside India

- Royalty (Bullet 1 to 3) / FTS (Bullet 2 & 3) :-

ROYALTY / FTS ” ARISE ” UNDER THE ACT – PAYMENTS BY NON RESIDENT

- Only when payable for : –

- Royalty (Bullet 1 to 3) / FTS (Bullet 2 & 3) :-

- Paid for any right/ property or information used for business/ profession in India

- Services utilized for business/ profession in India

- Making or earning any income from any source in India

- Royalty (Bullet 1 to 3) / FTS (Bullet 2 & 3) :-

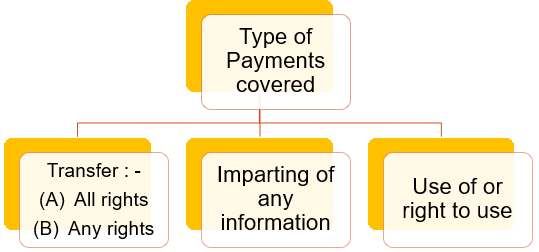

ROYALTY UNDER IT ACT – TYPES OF PAYMENTS COVERED

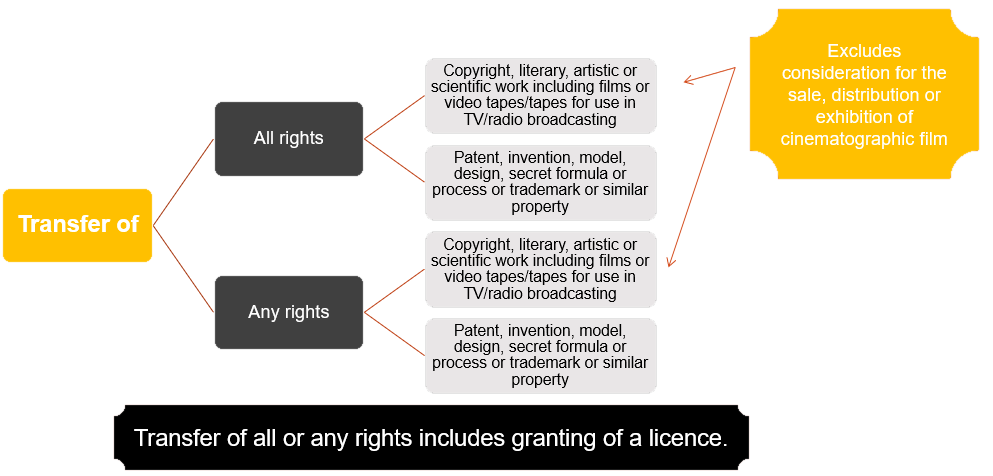

ROYALTY UNDER THE IT ACT – 9(1) (VI) – EXPLANATION 2

“royalty” means consideration (including any lump sum consideration but excluding any consideration which would be the income of the recipient chargeable under the head “Capital gains”) for—

(i) the transfer of all or any rights (including the granting of a licence) in respect of a patent, invention, model, design, secret formula or process or trade mark or similar property ;

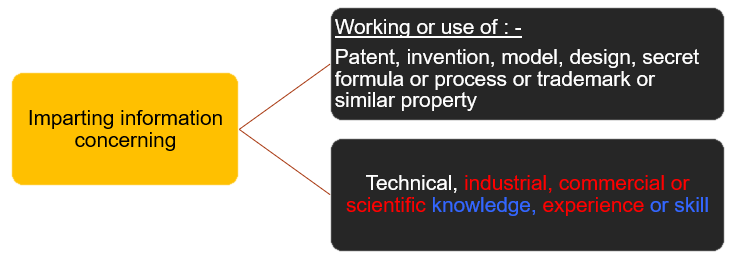

(ii) the imparting of any information concerning the working of, or the use of, a patent, invention, model, design, secret formula or process or trade mark or similar property ;

(iii) the use of any patent, invention, model, design, secret formula or process or trade mark or similar property ;

Learn More about “Article 12 – Royalty and Fees for Technical Services” – Subscribe International Tax Course

ROYALTY UNDER THE IT ACT – 9(1) (VI) – EXPLANATION 2

“royalty” means consideration (including any lump sum consideration but excluding any consideration which would be the income of the recipient chargeable under the head “Capital gains”) for—

(iv) the imparting of any information concerning technical, industrial, commercial or scientific knowledge, experience or skill

(iva) the use or right to use any industrial, commercial or scientific equipment26 but not including the amounts referred to in section 44BB

(v) the transfer of all or any rights (including the granting of a licence) in respect of any copyright, literary, artistic or scientific work including films or video tapes for use in connection with television or tapes for use in connection with radio broadcasting, but not including consideration for the sale, distribution or exhibition of cinematographic films ; or

(vi) the rendering of any services in connection with the activities referred to in sub-clauses (i) to [(iv), (iva) and]

EXCEPTIONS TO ROYALTY UNDER THE IT ACT

Lump sum consideration for the transfer outside India of,

or the imparting of information outside India in respect of,

any data, documentation, drawing or specification relating to any patent, invention, model, design, secret formula or process or trade mark or similar property, if such income is payable in pursuance of an agreement made before the 1st day of April, 1976,

and the agreement is approved by the Central Government

ROYALTY FOR TRANSFER OF ALL OR ANY RIGHTS

COMMON COVERAGE AND COMPARISON

| S. No. | Topic | Act | Treaty |

| 1. | Transfer of all rights :- | ||

| •Copyright | Yes | ||

| •Literary work | Yes | ||

| •Artistic work | Yes | ||

| •Scientific work | Yes | ||

| •Films or video tapes/tapes for use in TV broadcasting | Yes | ||

| •films or video tapes/tapes for use in radio broadcasting | Yes | ||

| 2. | Transfer of any rights | ||

| •Copyright | Yes | ||

| •Literary work | Yes | ||

| •Artistic work | Yes | ||

| •Scientific work | Yes | ||

| •Films or video tapes/tapes for use in TV broadcasting | Yes | ||

| •films or video tapes/tapes for use in radio broadcasting | Yes | ||

| 3. | Transfer of all rights :- | ||

| •Patent | Yes | ||

| •Invention | Yes | ||

| •Model | Yes | ||

| •Design | Yes | ||

| •Secret formula or process | Yes | ||

| •Trademark | Yes | ||

| •Similar property | |||

| 4. | Transfer of any rights :- | ||

| •Patent | Yes | ||

| •Invention | Yes | ||

| •Model | Yes | ||

| •Design | Yes | ||

| •Secret formula or process | Yes | ||

| •Trademark | Yes | ||

| •Similar property |

IMPARTING OF ANY INFORMATION CONCERNING

COMMON COVERAGE AND COMPARISON

| S. No. | Topic | Act | Treaty |

| 5. | Imparting information concerning working or use of

:- |

||

| •Patent | Yes | ||

| •Invention | Yes | ||

| •Model | Yes | ||

| •Design | Yes | ||

| •Secret formula or process | Yes | ||

| •Trademark

• |

Yes | ||

| •Similar property | Yes | ||

| 6. | Technical, knowledge, experience or skill | Yes | |

| Industrial knowledge, experience or skill | Yes | ||

| Commercial knowledge, experience or skill | Yes | ||

| Scientific knowledge, experience or skill | Yes |

Learn More about “Article 12 – Royalty and Fees for Technical Services” – Subscribe International Tax Course

TAX DEDUCTIBILITY IN HANDS OF PAYER

- Not covered by Article 12

- Domestic tax laws limitations, including Section 40(a)(ia) shall be applicable

- TP provision shall apply and Royalty/FTS should adhere to the ALP

- Excess payment over and above ALP not taxable as RFTS

ARTICLE 12 (1) – INDIA USA TREATY – RIGHT OF THE STATE OF RESIDENCE TO TAX ROYALTY

Royalties and fees for included services

arising in a Contracting State (India) and

paid to a resident of the other Contracting State (USA)

may be taxed in that other State

KEY ASPECTS FOR CONSIDERATION ?

- Whether the payment under consideration is Royalty/ FIS – Article 12(3)/ 12(4) & 12(5)

- Whether the payment arises in India/ Country of residence – Act and Treaty ?

- Whether the Royalty/FTS has been “Paid” – Does payment criterion apply as per Treaty ?

- Whether the recipient is a resident of USA – Refer Article 4 ?

- Whether both India and USA have a right to tax such payment ?

“PAID”– HOW DOES IT IMPACTS TAXATION ?

Some Treaty use the word “paid”. Would this imply that the royalty is taxable in hands of Non resident only when it is paid ?

DECISION ON TAXATION IN HANDS OF NON RESIDENT ONLY ON PAYMENT BASIS

ARTICLE 12 (2) – INDIA USA TREATY – RIGHT OF SOURCE STATE TO TAX RFTS

However, such royalties and fees for included services

may also be taxed in the Contracting State

in which they arise (India) and according to the laws of that State (India)

but if the beneficial owner of the royalties or fees for included services

is a resident of the other Contracting State (USA) ,

the tax so charged shall not exceed : –

ARTICLE 12 (3) – INDIA USA TREATY – ROYALTIES

The term “royalties” as used in this Article means :

(a) payments of any kind received as a consideration for the use of, or the right to use,

any copyright of a literary, artistic, or scientific work, including cinematograph films or work on

film, tape or other means of reproduction for use in connection with radio or television

broadcasting, any patent, trade mark, design or model, plan, secret formula or process, or

for information concerning industrial, commercial or scientific experience, including gains

derived from the alienation of any such right or property which are contingent on the

productivity, use, or disposition thereof ; and

ARTICLE 12 (3) – INDIA USA TREATY – – ROYALTIES

The term “royalties” as used in this Article means : –

(b)payments of any kind received as consideration for the use of, or the

right to use, any industrial, commercial, or scientific equipment, other

than payments derived by an enterprise described in paragraph 1 of

Article 8 (Shipping and Air Transport) from activities described in

paragraph 2(c) or 3 of Article 8.

ROYALTY – CERTAIN SPECIFIC CASES

Free use of Patent , Trademark etc

If consideration is paid for services and as a part thereof the Indian service recipient is allowed use of Logo and trademark of overseas Institute ?

Whether use should be legitimate and under contract ?

Even illegitimate use compensation paid could be classified as royalties

Does accreditation amounts to use of “Trademark”

No – Anchor Health and Beauty Care case

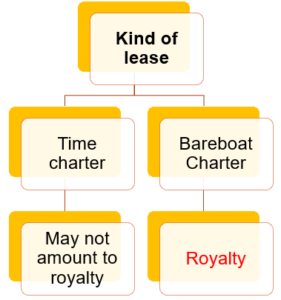

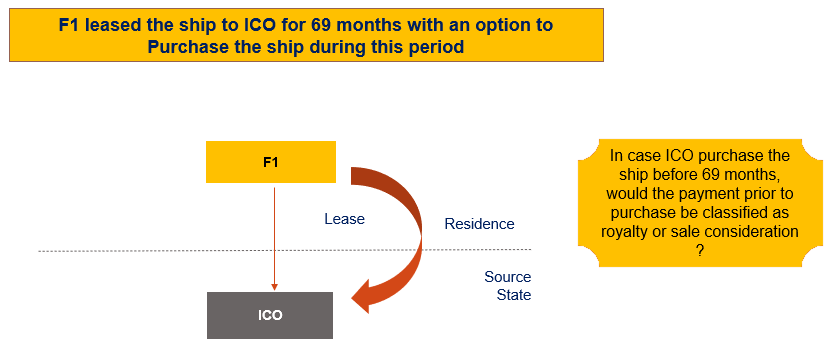

DRY VS WET LEASE – WHETHER USE OF EQUIPMENT

LEASE AND SALE OF SHIP

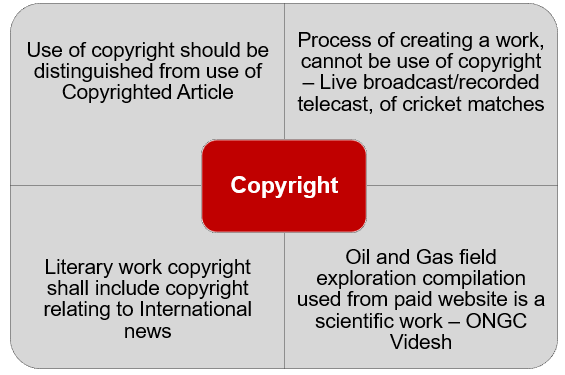

COPYRIGHT OF LITERARY, ARTISTIC OR SCIENTIFIC WORK

TRANSFER – COMPARISON OF ACT, OECD & UN MODEL

| S. No | Provision of Act | OECD Model | UN Model |

| 1. | Transfer of all or any rights (including the granting of a licence) in respect of a patent, invention, model, design, secret formula or process or trade mark or similar property | No corresponding provision | No corresponding provision |

| 2. | the transfer of all or any rights (including the granting of a licence) in respect of any copyright, literary, artistic or scientific work including films or video tapes for use in connection with television or tapes for use in connection with radio broadcasting, but not including consideration for the sale, distribution or exhibition of cinematographic films | No corresponding provision | No corresponding provision |

USE OR RIGHT TO USE – COMPARISON OF ACT, OECD & UN MODEL

| S. No | Provision of Act | OECD Model | UN Model |

| 1. | use of any patent, invention, model, design, secret formula or process or trade mark or similar property | Use of or right to use patent, trademark, design or model, plan, secret formula or process | Use of or right to use patent, trademark, design or model, plan, secret formula or process |

| 2. | use or right to use any industrial, commercial or scientific equipment but not including the amounts referred to in section 44BB | No corresponding provision | Use or right to use Industrial, commercial or scientific equipment included |

Learn More about “Article 12 – Royalty and Fees for Technical Services” – Subscribe International Tax Course

USE OR RIGHT TO USE – COMPARISON OF ACT, OECD & UN MODEL

| S. No’ | Provision of Act | OECD Model | UN Model |

| 1. | imparting of any information concerning the working of, or the use of, a patent, invention, model, design, secret formula or process or trade mark or similar property | No corresponding provision | No corresponding provision |

| 2. | the imparting of any information concerning technical, industrial, commercial or scientific knowledge, experience or skill | Imparting information concerning industrial, commercial or scientific experience | Imparting information concerning industrial, commercial or scientific experience |

ARTICLE 12 (4) – INDIA USA TREATY – FEE FOR INCLUDED SERVICES

For purposes of this Article, “fees for included services” means payments of any kind to any person in consideration for the rendering of any technical or consultancy services (including through the provision of services of technical or other personnel) if such services :

(a) are ancillary and subsidiary to the application or enjoyment of the right, property or information for which a payment described in paragraph 3 is received ; or

(b) make available technical knowledge, experience, skill, know-how, or processes, or consist of the development and transfer of a technical plan or technical design.

FEE FOR INCLUDED SERVICES – MEANING

Ancillary and Subsidiary to Royalty

Are ancillary and subsidiary to the application or enjoyment of the right, property or information for which a payment described in paragraph 3 is received

What all services are covered

- Technical

- Managerial

- Consultancy

Provision of services of technical or other personnel covered ?

Covered

Make Available

If services do not make available, not covered within FIS and hence not taxable

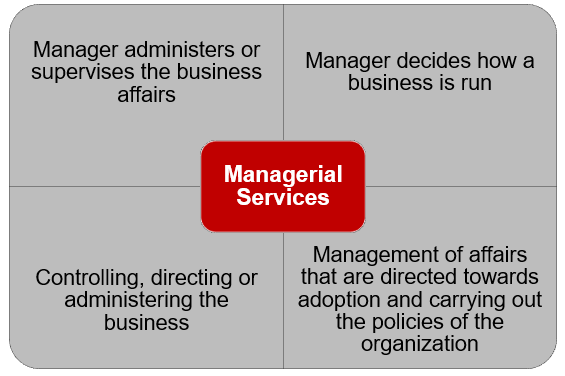

MANAGERIAL SERVICES

TECHNICAL SERVICES

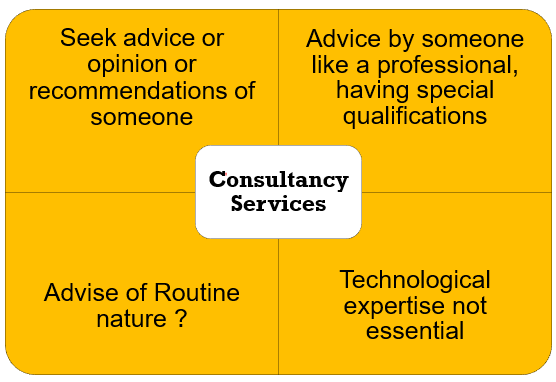

CONSULTANCY SERVICES

MAKE AVAILABLE

INDIAN DTAA’S WITH MAKE AVAILABLE CLAUSE

• Memorandum of Understanding to the India US DTAA

• Generally speaking, technology will be considered “made available” when the person acquiring the service is enabled to apply the technology. The fact that the provision of the service may require technical input by the person providing the service does not per se mean that technical knowledge, skills, etc., are made available to the person purchasing the service, within the meaning of paragraph 4(b). Similarly, the use of a product which embodies technology shall not per se be considered to make the technology available.

• UK, Singapore, Australia, Canada also have “make available” clauses

SERVICES THAT MAY INVOLVE THE DEVELOPMENT AND TRANSFER OF TECHNICAL PLANS/ DESIGNS

• Engineering services (including the sub-categories of bioengineering and aeronautical, agricultural, ceramics, chemical, civil, electrical, mechanical, metallurgical, and industrial engineering) ;

• Architectural services ; and

• Computer software development.

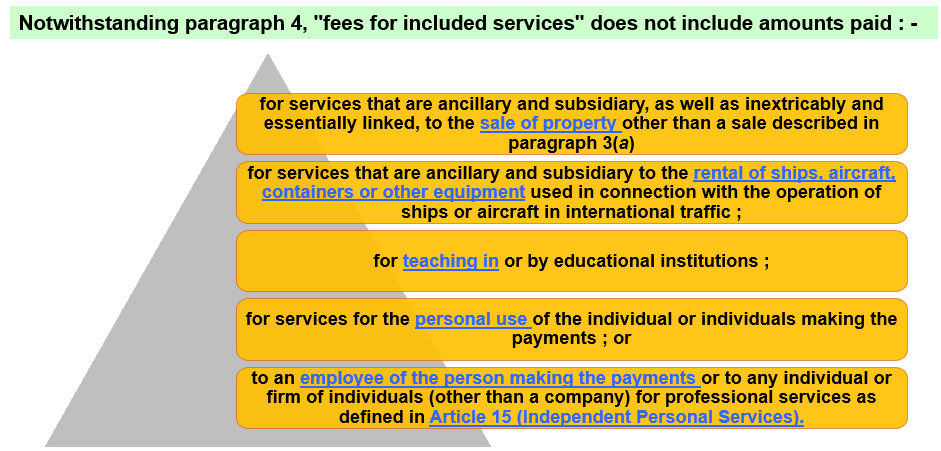

ARTICLE 12 (5) – INDIA USA TREATY – FIS EXCLUSION

ARTICLE 12 (6) – PE OR FIXED BASE & ROYALTIES TAXATION

The provisions of paragraphs 1 and 2 shall not apply

if the beneficial owner of the royalties or fees for included services,

being a resident of a Contracting State,

carries on business in the other Contracting State,

in which the royalties or fees for included services arise,

through a permanent establishment situated therein,

or performs in that other State independent personal services from a fixed base situated therein,

and the royalties or fees for included services are attributable to such permanent establishment or fixed base.

In such case the provisions of Article 7 (Business Profits) or Article 15 (Independent Personal Services), as the case may be shall apply.

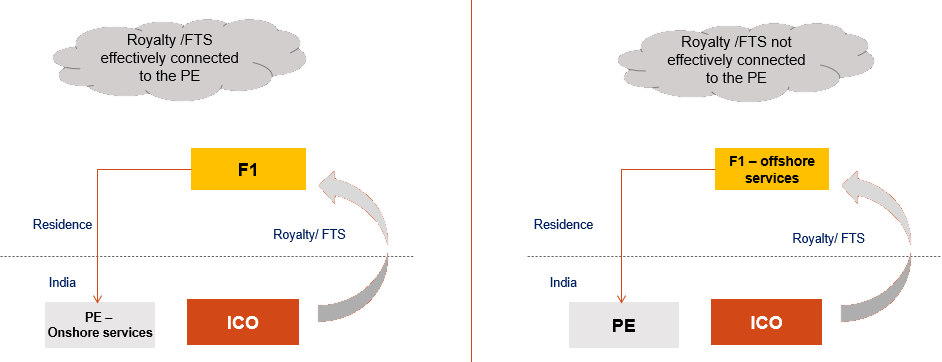

ARTICLE 12 (6) – PE OR FIXED BASE

ARTICLE 12 (6) – EFFECTIVE CONNECTION TO PE

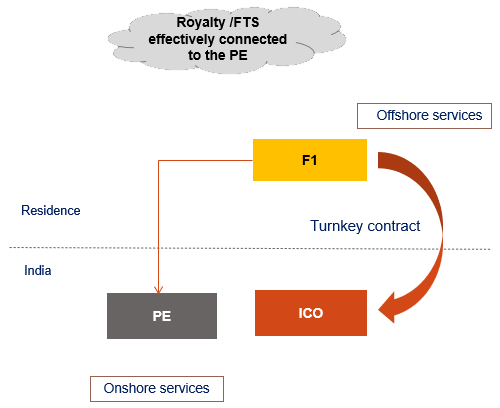

- F1 entered into a contract with ICO to supply certain equipment, provide drawings and design (offshore) and certain onshore installation services ;

- It had a branch office in India which constituted a PE of F1 in India and provided onshore services and coordinated with F1 to assist in drawings and design made offshore that were controlled by India PE

Issue

- Whether offshore services were effectively connected to the PE in India ?

Held

- Yes

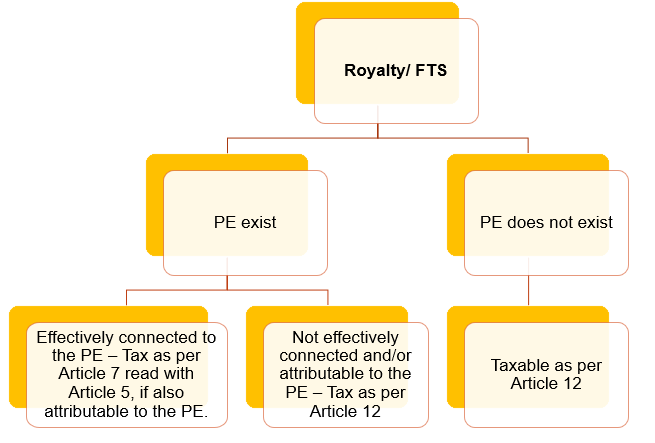

KEY QUESTIONS TO UNDERSTAND APPLICATION OF ARTICLE 12(6)

- Whether a PE/ Fixed base exist in India through which business is carried on – Refer Article 5 and 14

- Are royalties effectively connected (attributable) to the PE/ Fixed Base ?

- Whether the condition of beneficial ownership of royalty exists ?

- Resident of Foreign country – Article 4

EFFECTIVELY CONNECTED

- Whether the Asset for which the royalty is paid is of the PE or Head office ?

- What is the business of the PE and do the royalty arise from such business ?

- Does continuance of business is required by PE for effective connection ?

TAXATION OF RFTS AND PE – EFFECTIVE CONNECTION ?

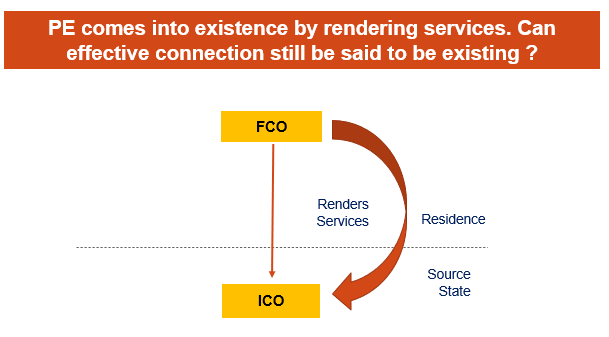

FTS – WHETHER EFFECTIVELY CONNECTED ?

What are the activities/functions of the PE ?

Is PE engaged in the same business as the nature of income of FTS ?

Who renders the services ?

Is it the PE itself or a group company/ Head office ?

If PE is not rendering the services, does it has a role in overall activities ?

If no Role, cannot be said to be effectively connected

When did the PE come into existence ?

- Before rendering services ?

- After rendering services ?

- Due to rendering services ?

SERVICE PE AND FTS/ ROYALTY

Learn More about “Article 12 – Royalty and Fees for Technical Services” – Subscribe International Tax Course

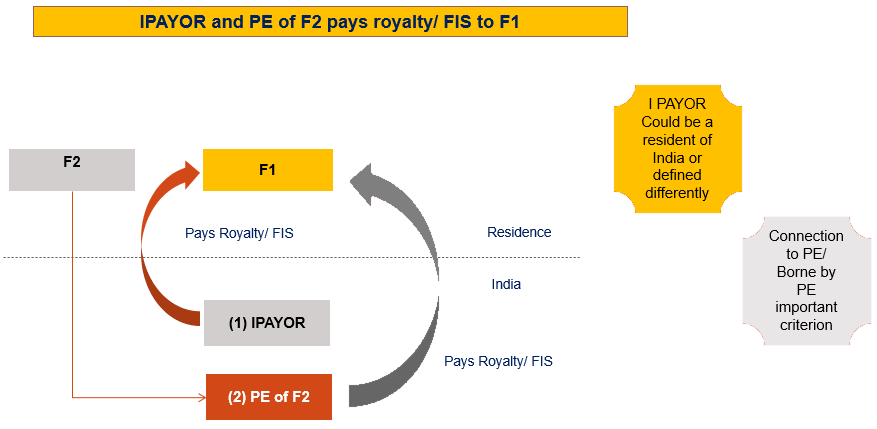

ARTICLE 12 (7) – INDIA USA TREATY

(a) Royalties and fees for included services shall be deemed to arise in a Contracting State when the payer is that State itself, a political sub-division, a local authority, or a resident of that State.

Where, however, the person paying the royalties or fees for included services, whether he is a resident of a Contracting State or not, has in a Contracting State a permanent establishment or a fixed base in connection with which the liability to pay the royalties or fees for included services was incurred, and such royalties or fees for included services are borne by such permanent establishment or fixed base, then such royalties or fees for included services shall be deemed to arise in the Contracting State in which the permanent establishment or fixed base is situated.

ARTICLE 12 (7) – INDIA USA TREATY

Where under sub-paragraph (a)

royalties or fees for included services do not arise in one of the Contracting States,

and the royalties relate to the use of, or the right to use, the right or property, or

the fees for included services relate to services performed,

in one of the Contracting States,

the royalties or fees for included services shall be deemed to arise in that Contracting State.

ARISING OF ROYALTY/ FIS

CASE STUDY – PAYMENT FOR RIGHT TO BROADCAST LIVE MATCHES BY NR TO NR

ARTICLE 12 (8) – INDIA USA TREATY

Where,

by reason of a special relationship

between the payer and the beneficial owner or

between both of them and some other person, the amount of the royalties or fees for included services paid exceeds the amount which would have been paid in the absence of such relationship,

the provisions of this Article shall apply only to the last-mentioned amount.

In such case, the excess part of the payments shall remain taxable according to the laws of each Contracting State, due regard being had to the other provisions of the Convention.

SPECIAL RELATIONSHIPS & EXCESS PAYMENTS

MOST FAVORED NATION CLAUSE (MFN CLAUSE)

If after the signature of this convention under any Convention or Agreement between India and a third State which is a member of the OECD India should limit its taxation at source on dividends, interests, royalties, fees for technical services or payments for the use of equipment to a rate lower or a scope more restricted than the rate or scope provided for in this Convention on the said items of income, then as from the date on which the relevant Indian Convention or Agreement enters into force the same rate or scope as provided for in that Convention or Agreement on the said items of income shall also apply under this Convention

Learn More about “Article 12 – Royalty and Fees for Technical Services” – Subscribe International Tax Course