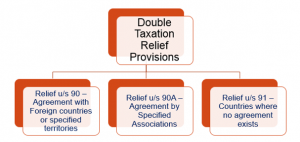

AGREEMENT WITH FOREIGN COUNTRIES OR SPECIFIED TERRITORIES – BILATERAL RELIEF – SECTION 90 (1)

- Central Government may enter into an agreement, with the Government of any country outside India or specified territory outside India, —

- For GRANTING OF RELIEF in respect of –

- Income, where income-tax has been paid both in India and in country of residence of taxpayer or specified territory; or

- income-tax chargeable under the IT Act and under the corresponding law in force in that country or specified territory to promote mutual economic relations, trade and investment; or

- For GRANTING OF RELIEF in respect of –

AGREEMENT WITH FOREIGN COUNTRIES OR SPECIFIED TERRITORIES – BILATERAL RELIEF – SECTION 90

a. for AVOIDANCE OF DOUBLE TAXATION of income,

under the IT Act, 1961 and under the corresponding law in force in that country or specified territory; or

b. for EXCHANGE OF INFORMATION for –

prevention of evasion or avoidance of income-tax chargeable under the IT Act, 1961 or under the corresponding law in force in that country or specified territory or

investigation of cases of such evasion or avoidance; or

c. RECOVERY of income-tax.