Here is the CA Final Paper 6C – Elective Paper International Taxation, May 2018

Total No. of Case Study Questions – 3

Time Allowed – 4 Hours

Maximum Marks – 100

GTRW

Answers to questions are to be given in English except in the case of candidates who have opted for Hindi Medium. If a candidate who has not opted for Hindi Medium, his/her answers in Hindi will not be valued.

The Question Paper comprises three Case Study questions. The candidates are required to answer any two case study questions out of three.

In case, any candidate answers extra question(s) / sub – question(s) over and above the required number, then only the requisite number of questions first answered in the answer-book shall be valued and subsequent extra question(s) answered shall be ignored. All questions relate to the Income – Tax Act, and Assessment Year 2018-19, unless stated otherwise in the questions.

Working notes should from part of your answer.

Marks

- Sigma Corporation Ltd. (SCL), is a company incorporated under the Companies Act, 2013, having factory and registered office in Mumbai. It is engaged in manufacture, purchase and sale of men’s wear, selling various kinds of garment products according to the requirement of the buyers across the world. The company has sold different garment products in the Financial Year 2017-18 to different vendors in the Indian and outside Indian market, including sale of T-shirts to one its associated enterprises namely John Miller of UK, to whom it had sold 2,50,000 pieces at the rate of Rs. ` 1,000 per piece.

Major portion of the income of SCL is from sale of manufactured products. The company (SCL) maintains a gross profit margin of 30% on the selling price. However, it has purchased the T-shirts sold to its UK based associated enterprise John Miller from Mudra Garments Ltd. of Ahmedabad at a price of Rs. 840 per piece.

Following functional differences were noted between the transaction with the UK based customer and other parties;

(a) Sales to third parties had been made with a specialized packaging for which 3% margin is included in the selling price.

(b) Tagging on the product purchased is being required by the other clients for which cost was Rs. 3 per piece, whereas in case of sales made to John Miller of UK, no tagging is to be done.

(c) Products sold to third parties involve a credit period of 6 months for which 0.5% per month margin on selling price is ensured by Sigma Corporation Ltd.

SCL, for the purpose of diversification, is now contemplating to expand its business operations by establishing an affiliate in the Mediterranean. Two countries under consideration of the Board of SCL are Spain and Cyprus. SCL intends to repatriate all after-tax foreign source income from the affiliate to India. In India, the corporate income may be taken as 30 percent. At this point, Sigma Corporation Ltd. is not certain whether it would be better to establish the affiliate operation in two countries as a branch operation or a wholly-owned subsidiary of the parent company.

GTRW Marks

In Cyprus, the marginal corporate tax rate is 20 percent and the foreign branch profits are also taxed at the same rate. In Spain, the corporate income is taxed at 25 percent and additionally, foreign branch income is also taxed at the same rate of 25 percent.

The withholding tax treaty rates with India on dividend income paid from Cyprus is 15 percent and when paid from Spain is 20 percent.

The Chief Financial Officer (CFO) of the company appraised the Board of Directors that the matter of the company pending before the tax authorities are involving several issues for which a show cause notice for A.Y. 2015-16 has been issued by the A.O. The issues of concern as has been raised in this notice in brief are :

(i) The company has not maintained proper records of the international transactions required under the Income – tax Act, 1961 (Act) and has also defaulted in not obtaining the report of the auditors within the prescribed time.

(ii) The transactions entered into with the associated enterprises during the previous year for determination of ALP have been referred by the AO to the TPO on 22.12.2017 for the reason of under – reporting.

(iii) The total international transactions carried out by the company during the previous year were of Rs. 200 crores and why penal action should not be taken against the company for the defaults stated in para – 1.

The CFO further informed that the TPO to whom a reference was made by the A.O., had of his own, selected one more party M/s Sun Apparels for determination of the ALP, which is an un-related person and not an associated enterprise but based at UK and whether it is resident or non – resident is also not known.

SCL is contemplating to file an application for advance ruling with the Authority for Advance Ruling.

The Board of SCL now asked you to help them by advising in determination in the context of taxation provisions contained under the Act, relating to international business as prevailing in India and other countries, as well as the expert opinion on the various issues raised in the show cause notice by the AO as appraised by the CFO.

Required :

(a) (i) Determine the Arm’s Length Price (ALP) of the transactions of sale of

T-shirts during the year to the AE John Miller of UK and its probable impact on the income of the company for AY 2018-19. 6

(ii) Can TPO invoke his powers in relation to an international transaction not referred to him ? Is the action taken by the TPO in relation to determination of ALP of the transactions undertaken by the company with M/s Sun Apparels of UK is justified ? 4

(b) (i) Where and in which country should the new affiliate be situated and which organizational structure (i.e. wholly owned subsidiary or branch) is to be selected? 7

(ii) Discuss whether the total tax liability in Cyprus or in Spain would be the least for operating a foreign branch or a wholly owned subsidiary of the parent company. 3

(c) (i) What will be the consequences for the defaults specified by the AO in the show cause notice of not maintaining the records, not obtaining of the report from the auditors and under reporting of ALP of the international transactions ? 5

(ii) What will be the impact on the time limit for completion of assessment by the AO because of reference so made to the TPO and if the company gets a stay for a period of 30 days over the proceedings then what will be the fate of the assessment proceedings ? 5

(d) Choose the most appropriate option for the following (option to be written in capital letter A, B, C or D) : 1 × 15 = 15

(1) Two methods were found suitable for determination of the Arm’s Length Price (ALP). As per CUP methods, it was found to be Rs. 1,200 per unit and as per resale price method, it was Rs. 1,250 per unit. The ALP per unit will be taken as

(A) Rs. 1,200 since it is more favourable to the assesses

(B) Rs. 1,250 since it is more favourable to the Department

(C) Rs. 1,225

(D) None of the above

(2) An assessee having specified domestic transactions covered by section 92BA, should furnish audit report, if the value of such transactions exceeds

(A) Rs. 2 crores (B) Rs. 20 crores

(C) Rs. 10 crores (D) None of the above

(3) An assessee deriving income from profits of business of an eligible industrial undertaking for which 100% deduction is available u/s 80-1B has entered into international transactions with an associated enterprise for Rs. 200 crores. The TPO has made an addition of Rs. 15 crores in respect of the ALP. The normal GP margin is 10%. The additional deduction u/s 80-1B which can be claimed by the assessee on account of the increase in the ALP is

(A) Nil (B) Rs. 20 crores

(C) Rs. 25 cores (D) Rs. 15 crores

(4) The OECD member countries have accepted the concept of Arm’s Length Price (ALP) for reaping the following benefit:

(A) Minimises double taxation

(B) Real taxable profits can be determined

(C) Artificial price distortion is reduced

(D) All the three above

(5) In the context of transfer pricing provisions, international transaction should be in the nature of

(A) Purchase, sale or lease of tangible or intangible property

(B) Provision of service

(C) Lending or borrowing money

(D) Any of the above

(6) Mr. Dhanush holds shares in both L Ltd., and M Ltd. In the context of transfer pricing provisions,

(A) L Ltd. and M Ltd. can never be associated enterprises.

(B) L Ltd. and M Ltd. are deemed associated enterprises if Mr. Dhanush holds 26% or more of voting power in each of these companies.

(C) L Ltd. and M Ltd. are deemed associated enterprises if Mr. Dhanush holds 26% or more of voting power in L Ltd., which in turn holds 26% or more of voting power in M. Ltd.

(D) L Ltd. and M Ltd. are deemed associated enterprises if Mr. Dhanush holds totally 52% or more combined voting power in both these companies.

(7) The book value of assets of SCL is Rs. 200 crores, whereas the market value of the said assets is 80 crores. Sun Ltd. has advanced a loan of Rs. 45 cores. In the context of transfer pricing provisions, SCL and Sun Ltd. are

(A) Not associated enterprises

(B) Associated enterprises, considering the book value of assets of SCL and its borrowings from Sun Ltd.

(C) Deemed to be associated enterprises, considering the book value of assets of SCL and its borrowings from Sun Ltd.

(D) Deemed to be associated enterprises considering the market value of assets of SCL and its borrowings from Sun Ltd.

(8) J Ltd. is controlled by Rajeev (HUF). K Ltd. is controlled by Raghav (sole proprietor of RR & Co.,), a close relative of Rajeev, a member of Rajeev (HUF). For the purpose of transfer pricing provisions,

(A) J Ltd. and K Ltd. are deemed associated enterprises.

(B) Rajeev HUF, J Ltd. and K Ltd., are deemed associated enterprises.

(C) RR & Co., Rajeev HUF, J Ltd. and K Ltd., are deemed associated enterprises.

(D) There is no associate enterprise relationship involved in this.

(9) There is an arrangement between SCL and Q Ltd., which are associated enterprises. Such arrangement is oral and is also not intended to be legally enforced. For transfer pricing purposes, such arrangement –

(A) is not treated as a “transaction” because it is not in writing.

(B) is not treated as a “transaction” because it is not intended to be legally enforced.

(C) is treated as a “transaction”.

(D) is not treated as a “transaction” for (A) and (B) above.

(10) The ALP determined by the TPO for some product is Rs. 2,000 per unit sold by SCL. Considering the tolerance band permitted by the CBDT, the tolerated international transaction price for a transaction with an associated enterprise can be upto

(A) Rs. 1,960 (B) Rs. 2,040

(C) Rs. 2,060 (D) None of the above

(11) Following can be an applicant for advance ruling :

(A) Non-resident entering into a transaction

(B) Resident entering into a transaction with a non – resident

(C) Resident entering into a transaction with another resident

(D) (A) or (B)

(12) An applicant for advance ruling may withdraw an application within _________ days from the date of the application.

(A) 30 (B) 60

(C) 90 (D) 120

(13) Composition of AAR is as under :

(A) A Chairman, Vice-Chairman and Revenue Member

(B) A Chairman, Vice-Chairman and Law Member

(C) A Chairman and such number of Vice – Chairman, Revenue Members and Law Members as the Central Government may, by notification, appoint.

(D) A Chairman, Vice-Chairman, Law Member and Revenue Member

(14) Following can make an application for advance ruling :

(A) Department (B) Applicant

(C) Central Government (D) All above

(15) Application for advance ruling is not allowed in the following situations :

(A) When the question involved is already pending before any income-tax authority.

(B) Where it is for determining the fair market value of a property.

(C) Excepting in exceptions, where the transaction in question is designed for avoidance of tax.

(D) Any one of the above

(e) Fill up blanks: 1 × 5 = 5

(i) The applicant desiring roll back of the APA may furnish the request for rollback provision in Form No. 3CEDA with proof of payment of an additional fee of _________.

(ii) The transfer pricing provisions contained in Section 92 shall not apply if the same has the effect of _________ chargeable to tax.

(iii) If there is an arrangement between SCL and TFL (an associate enterprise) for mark up of a semi-finished product and sale thereafter, the ideal method for determining the ALP is ________ method.

(iv) In a case where the aggregate value of international transactions exceeds Rs. ___________. It will be obligatory for the assessee to maintain the stipulated information and documents required for transfer pricing purposes.

(v) Where SCL has maintained proper records and documents …… the TPO has made income adjustments to the ALP, thereby increasing the total income by …. Rs 2 crores, the penalty leviable u/s 270A will be ? _______

- About the company

Rup Ram Limited (RRL) is a domestic company, with its head office located at Mumbai. The company ………….. dealing in manufacture, purchase and sale of several products.

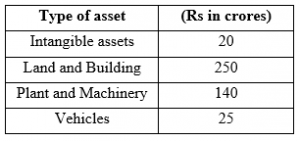

RRL possesses the following assets as on 31.3.2018 whose book values are as under:

The market value of these assets as on 31-3-2018 is Rs 750 crores.

Information from Manager, HR

Manager, Human Resources (HR) Division informs you that as on 31-3-2015, there were

340 employees, In the rolls of RRL resulting in wages/salary payments to the … of Rs

11.2 crores.

Subsidiary’s presence in India

RRL has a foreign subsidiary’s now White & Co. Inc. (SWC), incorporated in Singapore.

The subsidiary has assets present in India. It has 40 godowns in India, whose market value as on

31-3-2018 is Rs 40 crores, the book value … Rs 25 crores, split into Rs 10 crores for land

Component and balance for building portion. WDV as on 31-3-2018 for income-tax purposes is

Rs 13.2 crores

Other fixed assets (all purchased on 14-6-2017) are to the … of Rs 10 crores (WDV for the

purposes of the Income-tax Act, 1961 (Act) Rs 8.6 crores). Besides these, there is no other asset

in India.

At the beginning of the year, SWC had 22 godowns in India, whose market value was Rs 15

crores, the book value being Rs 10 crores, split into Rs 7 crores for land component and balance

for building portion. WDV for the Act purposes is Rs 6.7 crores.

Assets position of SWC outside India

As on 1-4-2017 As on 31-3-2018

No. of godowns owned 10 11

(All values in Rs crores)

Godowns: Land portion (Book value) 8 12

(Market value) 20 25

Godowns: Building part (Book value) 5 12

(Market value) 4.5

Godowns: Building part (WDV for taxation) 4.2 10.2

Other assets: (Book value) 12 20

(Market value) 14 22

(WDV for taxation) 10.2

Employees strength of SWC

There are 30 persons employed in India, for whom annual payment of Rs. 1.2 cores is incurred by SWC. There are 10 other persons, who, though not directly employed by SWC, perform the work like other employees. Outlay to them is Rs. 34 lakhs. All these employees are residents in India.

SWC employs 42 employees outside India, for whom the total payroll expenditure involved is Rs. 3 crores (converted into INR)

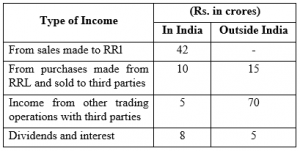

Income pattern from Indian operations of SWC

The income earned by SWC during the year ended 31-3-2018 from its Indian operations as well as other operations is as under :

Technical know how

RRL has entered into a complicated technical know-how agreement with Jew Inc., of Israel. The tax rate applicable and the amount taxable are posing to be ticklish. The annual payment of the technical know-how is likely to be around Rs. 150 crores. Jew Inc., has entered into identical agreements with three other Indian companies.

Sponsorship activities

RRL utilized the services of Graham Stokes, a British cricketer for playing in an important cricket league matches for a team sponsored by the company. He was paid a sum of Rs. 25 lakhs for paying in such matches. In addition, RRL paid him a sum of Rs. 6.76 lakhs for appearing in company’s advertisement for its product. Graham Stokes has incurred an expenditure of Rs. 1.2 lakhs in India for earning the said income.

Brain Thorpe, an ex-cricketer hailing from London, was used as a match referee in the said cricket tournaments. He was paid a sum of Rs. 5 lakhs for his services.

Required :

(a) Find the most suitable alternative to the following (option to be given in capital letters A, B, C or D): 1 × 10 = 10

(i) The person responsible for making payment of income by way of interest or dividends in respect of bonds or Global Depository Receipts referred to in section 115 AC, shall deduct tax at the rate of

(A) 10%

(B) 10.3%

(C) 20%

(D) (B) or at the rate specified in the DTAA, whichever is lower.

(ii) The rate of deduction of tax from interest payable to a foreign company (located in a country with which there is no DTAA) by an Indian company on borrowings made on 12-6-2017 in foreign currency from sources outside India is

(A) 5.15% (B) 10.3%

(C) 15.45% (D) None of the above

(iii) Surcharge applicable to a foreign company whose total income is Rs. 1.2 crores is

(A) Nil (B) 2%

(C) 7% (D) 10%

(iv) Following income which is accruing or arising outside India, directly or indirectly is not deemed to be income accruing or arising in India :

(A) Through or from any business connection in India.

(B) Through or from any property in India.

(C) Through transfer of capital asset located outside India.

(D) Through or from any asset or sources of income in India.

(v) Remuneration received for services rendered in India by a foreign national employed by foreign enterprise is exempt, if the number of days stay in India of such foreign national does not exceed

(A) 60 days (B) 90 days

(C) 30 days (D) None of above

(vi) A resident in relation to his tax liability arising out of one or more transactions valuing Rs. __________ in total which has been undertaken or is proposed to be undertaken would be eligible to be an applicant for advance ruling :

(A) 60 crore or more (B) 80 crore or more

(C) 100 crore or more (D) 200 crore or more

(vii) An applicant, who has sought for an advance ruling, may withdraw the application within __________.

(A) 30 days from the date of the application

(B) 30 days from the end of the month in which the application has been made

(C) 60 days from the date of the application

(D) 60 days from the end of the month in which the application has ben made

(viii) In case of a non-notified resident, the AAR will not allow an application in respect of certain matters. The following is not covered in the hit list :

(A) Matter pending with income – tax authorities/tribunal/court.

(B) Determination of fair market value of a property.

(C) Relates to a transaction or issue which is designed prima facie for avoidance of income – tax.

(D) Whether an arrangement, which is proposed to be undertaken by any person being a resident or a non – resident, is an impermissible avoidance arrangement as referred to in Chapter X-A or not.

(ix) The advance ruling given by the Authority for Advance Ruling (AAR) is not binding on the following person(s):

(A) On the applicant who sought the ruling.

(B) On the other person to the transaction entered into by the applicant, if it is non – resident.

(C) On the other person to the transaction entered into by the applicant, whether it is resident or non – resident.

(D) On the Principal Commissioner or Commissioner and the income- tax authorities subordinate to the Principal Commissioner or Commissioner who has jurisdiction over the application.

(x) Following income from ‘Salaries’ which is payable by __________ would be deemed to accrue or arise in India:

(A) The Government to a citizen of India for services rendered outside India.

(B) The Government to a non-resident for services rendered outside India.

(C) The Government to a non-citizen or non-resident for services rendered outside India.

(D) The Government or any other person to a non-citizen or non – resident for services rendered outside India.

(b) State with reasons, whether the following statements are true or false :

(i) When interest payable to a non – resident by the Government or a public sector bank within the meaning of section 10(23D), deduction of tax shall be made at the time of payment thereof in cash or by the issue of a cheque or draft or by any other mode, or at the time of credit of such interest to the account of the non – resident, whichever is earlier. 2

(ii) Where payment is made to a non – resident, even if such non – resident falls within the specified class notified by the CBDT, even if the payment is not chargeable to tax in India, the payer has to be make an application to the Assessing Officer, before making the impugned payment. 5

(iii) Where any interest is payable by a person resident in India, the same is deemed to accrue or arise in India. 3

(c) Graham Strokes and Brian Thorpe wish to avail the special provisions applicable to non – residents. The Managing Director of RRL wants to know about the obligation to deduct tax at source from the payments made to the aforesaid two persons. 7

If in both the situations above, there is an agreement between RRL and the two British persons that the tax payable on such income in India will be borne by RRL, then what is the amount of tax to be deducted at source ?

Assume that there is no DTAA provision, conferring a lower rate of withholding tax.

(d) Jew Inc., has a sister concern Silver LLC., which has obtained advance ruling on an identical technical know-how agreement with another Indian company. Can RRL make use of this ruling for its assessment proceeding ? What course of action will you advise ? 4

(e) RRL has made an application to the Assessing Officer for determination of the tax rate applicable for the technical know-how payment to be made to Jew Inc. When this is pending, Jew Inc., has filed an application before the AAR. Can the AAR reject the application on the ground that similar issue is pending before the Assessing Officer? 6

(f) The Board of Directors wish to know whether the foreign subsidiary SWC will be regarded as a company engaged in active business outside India for POEM purposes. Advise them suitably. The Board is also looking for your suggestions in this regard. 13

- About the assessee

The assessee is a famous movie actor Mr. Ajitabh Khan (AK). He has business interest in few other nations as well. He is a resident in India for the Assessment Year 2018-19.

About yourself

You are the CEO of the company with CA background. You have sound knowledge of the Indian and Foreign tax laws. The date on which various events happened and have been summarized in this case study is 31-3-2018.

Phone call from Manager (Legal) 09.40 hours

A phone call has been received from the Manager (Legal) that a search is being conducted by the Income-tax department at one of the premises of the assessee. No further details are available now.

E-mail from Taxation Manager at 18.00 hours

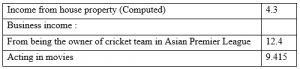

The Taxation Manager has emailed you the summarized information of income earned by AK during the year ended 31-3-2018 as under : (Rs. in crores)

AK has paid PPF of Rs. 1.2 lakhs and Life Insurance Premium of Rs. 2 lakhs.

Phone call from Manager (Legal) 20.30 hours

The search conducted by the IT Department has come to an end. It appears that some incriminating documents have been unearthed. It is likely that it has come to the notice of the Department that the assessee has earned income of Rs. 12 cores (as converted into INR) in Dubai during the Financial Year 2015-16, which has not been reflected in the return of income filed by AK for the Assessment Year 2016-17 or in any other year.

Further, the presence of certain building, in Panama Islands, which are not appearing in the books of account and financial statements filed with the IT Department. These buildings were purchased for 35.2 million USD on 12-3-2014. For acquiring this asset, brokerage of 2% has been paid to a real estate agent.

Additionally, there are materials to show that the assessee owns 5 rare pieces of art work, acquired on 12-6-2016. In Macau Islands for a price of 3.8 million USD.

E-mail from International Division Manager at 21.00 hours

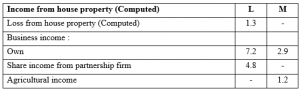

The International Division Manager has intimated details of income earned from two countries outside India, L and M, with which India does not have any Double Taxation Avoidance Agreement. The summarized data are as under : (Rs. in crores)

In country L, share income is not exempt and loss from house property is not eligible for being set off against other income. In country M, agricultural income is also chargeable to income-tax.

In country L, AK has paid income-tax of Rs. 2.16 crores and in country L, Rs. 80 lakhs on the total income earned there.

Inputs from Forex Team (Email received at 21.15 hours)

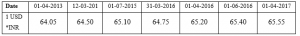

The prevailing rates of exchange on various dates are as under :

Email from Xavier LLP (Registered valuers) at 23.45 hours

The fair market value of the assets acquired abroad were indicated by the registered valuers on various dates are thus :

Payment made to foreign player

Mr. Ajmal Kamal, a non-resident player was called for one of the Asian Premier League Matches, for which Rs. 20 lakhs was paid to him. The withholding tax mentioned in the DTAA with the nation in which the said actor resides, is 15%.

Required :

(a) Find the most suitable alternative for the following (Option to be given in capital letters A, B, C or D): 1 × 10 = 10

(i) A shopping complex was purchased by the assessee in Colombo for Rs. 5 crores on 12-3-2015. Out of this, investment of Rs. 3 crores is from disclosed so9urces, which had been offered for tax. This asset comes to the knowledge of the Assessing Officer on 27-12-2017. If the fair market of the house as on the relevant date to be adopted is Rs. 8 crores, the undisclosed foreign income under the Black money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 (BM Act) will be taken as (Rs. crores)

(A) 5 (B) 3.2

(C) 3.8 (D) None of the above

(ii) Under the BM Act, the rate of exchange to be adopted for conversion purposes will be the rate specified by

(A) RBI (B) SBI

(C) Central Government (D) CBDT

(iii) The Assessing Officer has detected undisclosed foreign income of Rs. 3 crores earned during the year ended 31-3-2017. There is foreign loss of Rs. 1.2 crores also, hitherto not shown in the income – tax return filed for the Assessment Year 2017-18. The quantum of undisclosed foreign income assessed under the BM Act will be

(A) Rs. 1.8 crores (B) Rs. 1.2 crores

(C) Rs. 3 crores (D) None of the above

(iv) Unquoted shares acquired in Tokyo during on 21-3-2016 came to the notice of the Assessing Officer on 12-3-2018. There is no explanation of the source for the same. The converted value of the shares on 21-3-2016, 1-4-2016, 1-4-2017 and 1-4-2018 are Rs. 12, 13, 14, and 15 crores respectively. The undisclosed foreign income representing the value of the undisclosed foreign asset, as per the BM Act is

(A) Rs. 12 crores (B) Rs. 13 crores

(C) Rs. 14 crores (D) Rs. 15 crores

(v) Under the BM Act, a tax authority below the rank of Commissioner can retain the impounded books normally for a period of

(A) 120 days (B) 90 days

(C) 60 days (D) 30 days

(vi) In a typical Tax Convention based on OECD model or UN model, the definition of the term “national” is primarily relevant to the Article dealing with ____________.

(A) Persons covered/General scope

(B) Non-discrimination

(C) Resident

(D) Credit Method

(vii) Controlled Foreign Corporations (CFCs) are __________ entities incorporated in an overseas low tax jurisdiction.

(A) Corporate

(B) Non-Corporate

(C) Both corporate and Non-corporate

(D) None of the above

(viii) Existence of a _______ in a jurisdiction is a pre-requisite for the purpose of taxation of business profit of an enterprise in that jurisdiction, major Tax Convention :

(A) Business connection

(B) Permanent establishment

(C) Business or professional connection

(D) Any connection giving rise to the said profit

(ix) For the purpose of equalization levy, “specified service” means

(A) Online advertisement

(B) Any provision for digital advertising space or any other facility or service for the purpose of online advertisement.

(C) Specified Service also includes any other service as may be notified by the Central Government.

(D) All of the above.

(x) Following is not an anti-tax avoidance measure in the context of international taxation :

(A) TIEAS (B) POEM

(C) GAAP (D) Transfer pricing provisions

(b) Test the correctness of the following statements, with brief reasons :

(i) A tax authority under the BM Act shall be deemed to be a civil court for all intents and purposes. 3

(ii) Any payment received for online advertisement will attract equalization levy of 6%. 3

(iii) ABC Ltd. is a domestic company. It has a foreign subsidiary FGH Inc., in a tax haven. If the place of effective management is found to be in India, under the CFC legislation, the entire income of FGH Inc,. can be taxed in India and FGH Inc., can be treated as a domestic company for several other purposes as well. 4

(c) Discuss whether AK has fulfilled the requisite conditions for grant of relief under section 91. 5

(d) AK wants to know the income-tax liability for the Assessment Year 2018-19, with workings. You are required to provide the same. 11

(e) Discuss briefly about the amount of TDS applicable for payment to Ajmal

Kamal. 3

(f) In respect of the foreign income and foreign assets unearthed by the Department during the search, discuss the tax implications under the Black Money (undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 (BM Act). AK wants to know the year of taxability and the tax amount. Your answer should also cover discussion on the applicable provisions concerned. 11