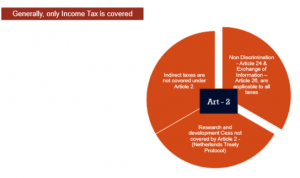

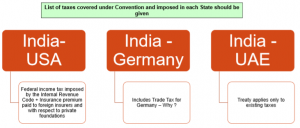

Article 2 – Taxes Covered under the Scope of the Treaty, deals with which “Taxes”, paid by the taxpayer, shall be eligible for benefit under the Treaty.

WHY IS ARTICLE 2 RELEVANT ?

WHICH TAXES ARE COVERED ?

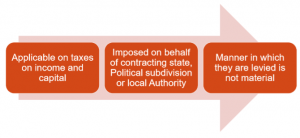

ARTICLE 2 (1) – INDIA NETHERLANDS TREATY

This Convention shall apply to

taxes on income and on capital

imposed on behalf of

one of the States or

of its political subdivisions or

local authorities,

irrespective of the manner in which they are levied

ARTICLE 2(1) – INDIA USA TREATY

The existing taxes to which this Convention shall apply are :

(a) In the United States, the Federal income taxes imposed by the Internal Revenue Code (but excluding the accumulated

earnings tax, the personal holding company tax, and social security taxes), and the exercise taxes imposed on insurance

premiums paid to foreign insurers and with respect to private foundations (hereinafter referred to as “United States Tax”);

provided, however, the Convention shall apply to the exercise taxes imposed on insurance premiums paid to foreign insurers only

to the extent that the risks covered by such premiums are not reinsured with a person not entitled to exemption from such taxes

under this or any other Convention which applies to these taxes ; and

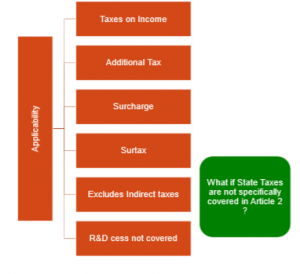

ARTICLE 2(1) – INDIA USA TREATY

(a) in India :

(i) the income-tax including any surcharge thereon, but excluding income-tax on undistributed income of companies, imposed under the Income-tax Act ; and

(ii) the surtax (hereinafter referred to as “Indian tax”).

Taxes referred to in (a) and (b) above shall not include any amount payable in respect of any default or omission

in relation to the above taxes or which represent a penalty imposed relating to those taxes

KEY FEATURES OF ARTICLE 2

WHICH TAXES ARE COVERED ?

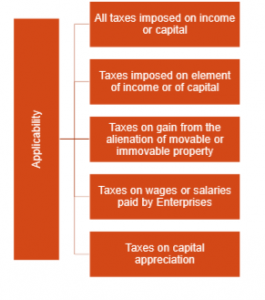

ARTICLE 2 (2) – INDIA NETHERLANDS TREATY

There shall be regarded as taxes on income and on capital

all taxes imposed on total income,

on total capital, or

on elements of income or of capital,

including taxes on gains from the alienation of movable or immovable property,

taxes on the total amounts of wages or salaries paid by enterprises,

as well as taxes on capital appreciation.

WHICH TAXES ARE COVERED ?

KEY FEATURES

ARTICLE 2(2) – INDIA USA TREATY

The Convention shall apply also to any identical or substantially similar taxes

which are imposed after the date of signature of the Convention

in addition to, or in place of, the existing taxes.

The competent authorities of the Contracting States shall notify each other

of any significant changes which have been made in their respective taxation laws and

of any official published material concerning the application of the Convention.

KEY FEATURE OF ARTICLE 2(2) OF INDIA USA TREATY

ARTICLE 2 (3) – GENERAL CLAUSE

The existing taxes to which the Convention shall apply are in particular :

(a) In the XYZ :

(b) In India :

ARTICLE 2(2) – INDIA UAE TREATY

1. ……

2. The existing taxes to which the Agreement shall apply are (added <<<>>>> ) :

(a) In United Arab Emirates :

(i) income-tax ;

(ii) corporation tax ;

(iii) wealth-tax

(hereinafter referred to as “U.A.E. tax”) ;

(b) In India :

(i) the income-tax including any surcharge thereon ;

(ii) the surtax ; and

(iii) the wealth-tax

(hereinafter referred to as “Indian tax”).

ARTICLE 2(3) – INDIA GERMANY TREATY

The existing taxes to which this Agreement shall apply are in particular :

(a) in the Federal Republic of Germany :

the Einkommensteuer (income-tax),

the Korperschaftsteuer (corporation-tax),

the Vermogensteuer (capital tax), and

the Gewerbesteuer (trade tax)

(hereinafter referred to as “German tax”);

(b) in the Republic of India,

the income-tax including any surcharge tax thereon (Einkommensteuer, einschl, darauf entfallender Zusatzsteuern), and the wealth-tax (Vermogensteuer) (hereinafter referred to as “Indian tax”).

KEY FEATURES OF ARTICLE 2(3)

3 thoughts on “Article 2 – Taxes Covered under the Scope of the Treaty/ DTAA”

Fine way of describing, and pleasant post to obtain information regarding my presentation subject matter,

which i am going to convey in institution of higher education.

Thank you for your appreciation . It means a lot to us

I am truly grateful to the owner of this web site who has shared this wonderful

paragraph at at this place.